UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

Kartoon Studios, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee previously paid with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

July 14, 2023

To Our Stockholders:

You are cordially invited to attend the 2023 annual meeting of stockholders (the “Annual Meeting”) of Kartoon Studios, Inc., a Nevada corporation (the “Company”), to be held at 10:00 a.m., Pacific Standard Time, on Friday, August 25, 2023. The Annual Meeting will be a virtual meeting of stockholders, which will be conducted solely by means of remote communication via a live webcast. For purposes of attendance at the Annual Meeting, all references in this proxy statement to “present in person” or “in person” shall mean virtually present at the Annual Meeting.

Details regarding the Annual Meeting, the business to be conducted at the Annual Meeting, and information about the Company that you should consider when you vote your shares are described in this proxy statement.

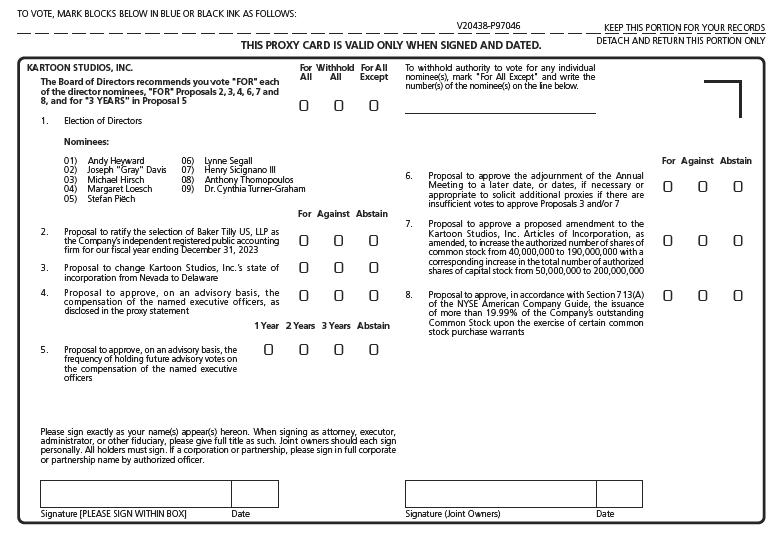

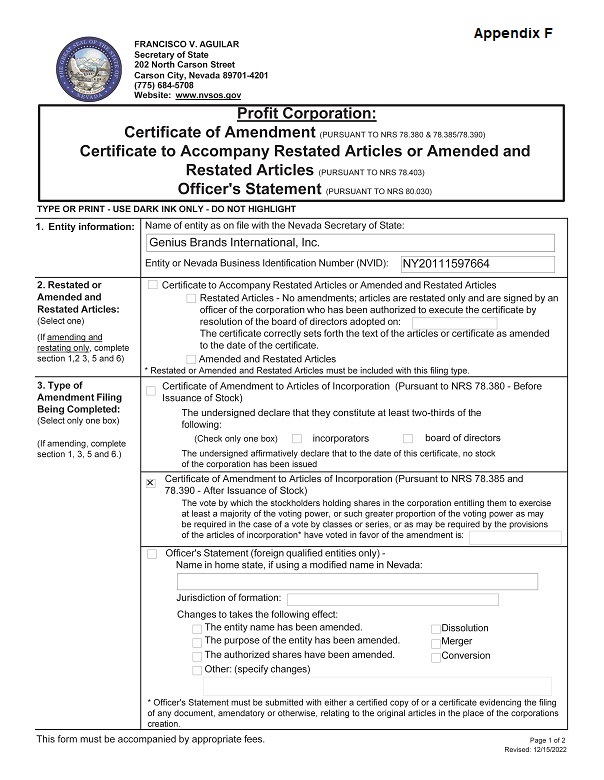

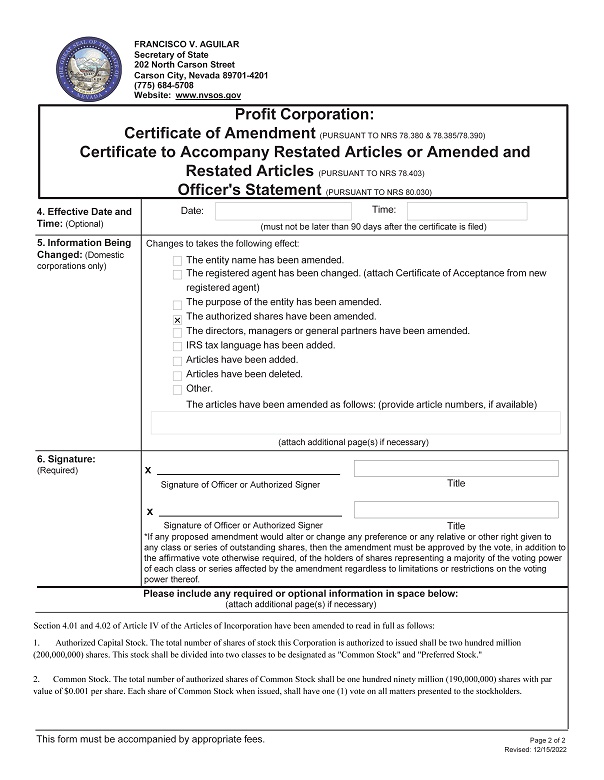

At the Annual Meeting, we will ask stockholders to (i) elect nine (9) persons to our board of directors (Proposal 1), (ii) ratify the appointment of Baker Tilly US, LLP as the Company’s independent auditors for our fiscal year ending December 31, 2023 (Proposal 2), (iii) approve a proposal to change the Company’s state of incorporation from Nevada to Delaware (Proposal 3), (iv) approve, by an advisory vote, the compensation of our named executive officers, as disclosed in this proxy statement (Proposal 4), (v) approve, by an advisory vote, the frequency of holding future advisory votes on the compensation of our named executive officers (Proposal 5), (vi) approve a proposal to adjourn the Annual Meeting to solicit additional proxies if there are insufficient votes at the time of the meeting to approve Proposals 3 and/or 7 (Proposal 6), (vii) approve a proposed amendment to the Company’s Articles of Incorporation, as amended (the “Articles of Incorporation”), to increase our authorized shares of common stock, par value $0.001 per share (the “Common Stock”), from 40,000,000 shares to 190,000,000 shares with a corresponding increase in the total number of authorized shares of capital stock of the Company from 50,000,000 shares to 200,000,000 shares (Proposal 7), and (viii) approve, in accordance with Section 713(A) of the NYSE American Company Guide, the issuance of more than 19.99% of our outstanding Common Stock upon the exercise of certain common stock purchase warrants (Proposal 8).

The board of directors recommends the approval of each of the proposals. Such other business will be transacted as may properly come before the Annual Meeting.

Under Securities and Exchange Commission rules that allow companies to furnish proxy materials to stockholders over the Internet, we have elected to deliver our proxy materials to the majority of our stockholders over the Internet. This delivery process allows us to provide stockholders with the information they need, while at the same time conserving natural resources and lowering the cost of delivery. On July 14, 2023, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement for the Annual Meeting and our 2022 Annual Report on Form 10-K. The Notice also provides instructions on how to vote online or by telephone and includes instructions on how to receive a paper copy of the proxy materials by mail.

We hope you will be able to attend the Annual Meeting. Whether you plan to attend the Annual Meeting or not, it is important that you cast your vote either during the Annual Meeting or by proxy before the Annual Meeting. You may vote over the Internet or by mail. When you have finished reading the proxy statement, you are urged to vote in accordance with the instructions set forth in the Notice and this proxy statement. We encourage you to vote by proxy so that your shares will be represented and voted at the meeting, whether or not you can attend.

Thank you for your continued support of the Company. We look forward to seeing you at the Annual Meeting.

| Sincerely, | |

| /s/ Andy Heyward | |

| Andy Heyward | |

| Chief Executive Officer and | |

| Chairman of the Board of Directors |

July 14, 2023

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

| TIME: | 10:00 a.m., Pacific Standard Time | |

| DATE: | Friday, August 25, 2023 | |

| PLACE: | The Annual Meeting will be held by means of remote communication via a live webcast accessible at www.virtualshareholdermeeting.com/TOON2023. You can attend the Annual Meeting online and vote your shares during the online meeting. To be admitted to the Annual Meeting’s live webcast, you must register to attend the virtual meeting by 11:59 p.m., Pacific Standard Time, on Friday, August 18, 2023, by visiting www.proxyvote.com, entering your 16-digit control number as shown in the Notice of Internet Availability of Proxy Materials (“Notice”), your proxy card, or the voting instruction form, and selecting “Attend a Meeting.” You will receive a confirmation email with information on how to attend the Annual Meeting. On the day of the meeting, you will be able to participate in the Annual Meeting by visiting www.virtualshareholdermeeting.com/TOON20 and entering the same 16-digit control number you used to pre-register and as shown in your confirmation email. Participation in the Annual Meeting is limited and access to the meeting will be accepted on a first come, first served basis, once electronic entry begins. Electronic entry to the Annual Meeting will begin at 9:45 a.m., Pacific Standard Time, on the day of the meeting. If you encounter any difficulties accessing the virtual meeting, please call the technical support number that will be posted on the virtual meeting page. | |

| PURPOSES: | ||

| 1. | To elect nine (9) directors to serve one-year terms expiring in 2024 (Proposal 1); | |

| 2. | To ratify the appointment of Baker Tilly US, LLP as the Company’s independent registered public accounting firm for our fiscal year ending December 31, 2023 (Proposal 2); | |

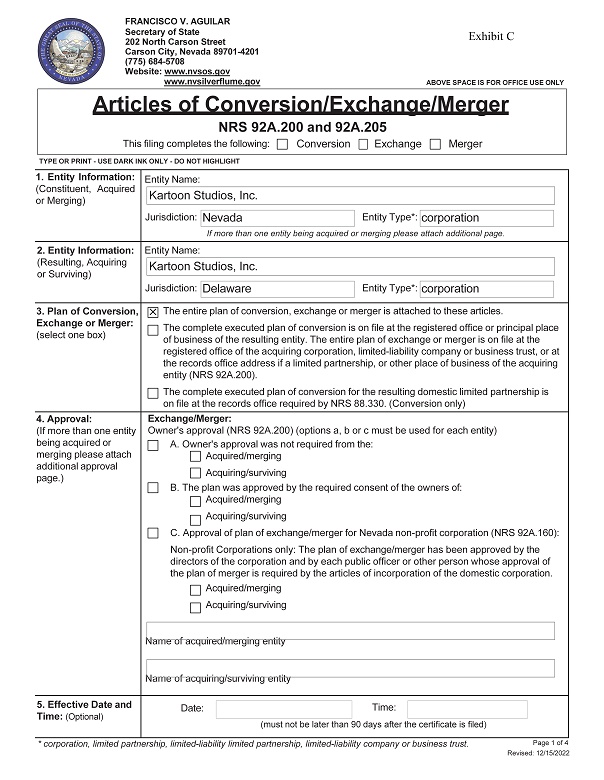

| 3. | To approve a proposal to change the Company’s state of incorporation from Nevada to Delaware (Proposal 3); | |

| 4. | To approve, by an advisory vote, the compensation of our named executive officers, as disclosed in this proxy statement (Proposal 4); | |

| 5. | To approve, by an advisory vote, the frequency of holding future advisory votes on the compensation of our named executive officers (Proposal 5); | |

| 6. | To approve a proposal to adjourn the Annual Meeting to solicit additional proxies if there are insufficient votes at the time of the meeting to adopt Proposals 3 and/or 7 (Proposal 6); | |

| 7. | To approve a proposed amendment to our Articles of Incorporation to increase our authorized shares of Common Stock from 40,000,000 shares to 190,000,000 shares with a corresponding increase in the total number of authorized shares of capital stock of the Company from 50,000,000 shares to 200,000,000 shares (Proposal 7); | |

| 8. | To approve, in accordance with 713(A) of the NYSE American Company Guide, the issuance of more than 19.99% of our outstanding Common Stock upon the exercise of certain common stock purchase warrants (Proposal 8); and | |

| 9. | To transact such other business that is properly presented at the Annual Meeting and any adjournments or postponements thereof. | |

WHO MAY VOTE:

You may vote if you were the record owner of the Company’s Common Stock at 5:00 p.m. Pacific Standard Time on June 27, 2023 (the “Record Date”). A list of stockholders of record will be available during the 2023 annual meeting of stockholders (the “Annual Meeting”) and the 10 days prior to the Annual Meeting at our principal executive offices located at 190 N. Canon Drive, 4th Floor, Beverly Hills, California 90210.

All stockholders are cordially invited to attend the Annual Meeting. Stockholders who plan to attend the Annual Meeting must register at www.proxyvote.com by 11:59 p.m., Pacific Standard Time, on Friday, August 18, 2023 (the “Registration Deadline”), as described in your Notice, proxy card, or voting instruction form. As part of the registration process, you must enter the 16-digit control number shown on your Notice, proxy card, or voting instruction form. After completion of your registration by the Registration Deadline, a confirmation email with information on how to attend the Annual Meeting will be emailed to you. For purposes of attendance at the Annual Meeting, all references in this proxy statement to “present in person” or “in person” shall mean virtually present at the Annual Meeting.

Whether you plan to attend the Annual Meeting or not, we urge you to vote by following the instructions in the Notice of Internet Availability of Proxy Materials that you previously received and submit your proxy by the Internet or mail in order to ensure the presence of a quorum. You may change or revoke your proxy at any time before it is voted at the Annual Meeting.

| BY ORDER OF THE BOARD OF DIRECTORS | |

| /s/ Michael Jaffa | |

| Michael Jaffa | |

| Corporate Secretary |

| i |

Kartoon Studios, Inc.

190 N. Canon Drive, 4th Floor

Beverly Hills, CA 90210

PROXY STATEMENT

KARTOON STUDIOS, INC.

2023 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON FRIDAY, AUGUST 25, 2023

This proxy statement, along with the accompanying Notice of 2023 Annual Meeting of Stockholders, contains information about the 2023 Annual Meeting of Stockholders of Kartoon Studios, Inc. (the “Annual Meeting”), including any adjournments or postponements of the Annual Meeting. We are holding the Annual Meeting at 10:00 a.m. Pacific Standard Time, on Friday, August 25, 2023, by means of remote communication via a live webcast accessible at www.virtualshareholdermeeting.com/TOON2023.

In this proxy statement, we refer to Kartoon Studios, Inc. as “the Company,” “we” and “us.”

This proxy statement relates to the solicitation of proxies by our board of directors for use at the Annual Meeting.

On July 14, 2023, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement for the Annual Meeting and our 2022 Annual Report on Form 10-K, which includes our financial statements for the fiscal year ended December 31, 2022.

| 1 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY

MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON FRIDAY, AUGUST 25, 2023

This proxy statement, the Notice of 2023 Annual Meeting of Stockholders, our form of proxy card and our 2022 Annual Report on Form 10-K to stockholders are available for viewing, printing and downloading at www.proxyvote.com. To view these materials please have your 16-digit control number(s) available that appears on your Notice or proxy card. On this website, you can also elect to receive future distributions of our proxy statements and annual reports to stockholders by electronic delivery.

Additionally, you can find a copy of our Annual Report on Form 10-K, which includes our financial statements, for the fiscal year ended December 31, 2022 on the website of the Securities and Exchange Commission, or the SEC, at www.sec.gov, or in the “SEC Filings” section of the “Investors” section of our website at www.kartoonstudios.com. You may also obtain a printed copy of our Annual Report on Form 10-K, including our financial statements, free of charge, from us by sending a written request to:

KARTOON STUDIOS, INC.

190 N. Canon Drive, 4th Floor

Beverly Hills, California 90210

Exhibits will be provided upon written request and payment of an appropriate processing fee.

| 2 |

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why is the Company Soliciting My Proxy?

Our board of directors is soliciting your proxy to vote at the 2023 annual meeting of stockholders to be held by means of remote communication via a live webcast accessible at www.virtualshareholdermeeting.com/TOON2023 on Friday, August 25, 2023, at 10:00 a.m. Pacific Standard Time, and any adjournments or postponements of the meeting, which we refer to hereinafter as the “Annual Meeting.” This proxy statement, along with the accompanying Notice of 2023 Annual Meeting of Stockholders, summarizes the purposes of the meeting and the information you need to know to vote at the Annual Meeting.

We have made available to you on the Internet or have sent you this proxy statement, the Notice of 2023 Annual Meeting of Stockholders, the proxy card and a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 because you owned shares of Kartoon Studios, Inc.’s common stock, par value $0.001 per share (the “Common Stock”) on the Record Date (as defined below). On July 14, 2023, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement for the Annual Meeting and our 2022 Annual Report on Form 10-K.

Why Did I Receive a Notice in the Mail Regarding the Internet Availability of Proxy Materials Instead of a Full Set of Proxy Materials?

As permitted by the rules of the U.S. Securities and Exchange Commission (the “SEC”), we may furnish our proxy materials to our stockholders by providing access to such documents on the Internet, rather than mailing printed copies of these materials to each stockholder. Most stockholders will not receive printed copies of the proxy materials unless they request them. We believe that this process should expedite stockholders’ receipt of proxy materials, lower the costs of the Annual Meeting and help to conserve natural resources. If you received the Notice by mail or electronically, you will not receive a printed or email copy of the proxy materials, unless you request one by following the instructions included in the Notice. Instead, the Notice instructs you as to how you may access and review all of the proxy materials and submit your proxy on the Internet. If you requested a paper copy of the proxy materials, you may authorize the voting of your shares by following the instructions on the proxy card, in addition to the other methods of voting described in this proxy statement.

Why is the Company holding the Annual Meeting virtually?

We are holding the Annual Meeting online and providing internet voting to facilitate stockholder attendance and participation by enabling all stockholders to participate fully, equally and without cost, using an Internet-connected device from any location around the world, with procedures designed to ensure the authenticity and correctness of your voting instructions. In addition, the virtual-only meeting format increases our ability to engage with all stockholders, regardless of size, resources or physical location. Our stockholders will be afforded the same opportunities to participate at the virtual Annual Meeting as they would at an in-person Annual Meeting.

Where can I get technical assistance?

If you encounter any difficulties accessing the virtual Annual Meeting, please call the technical support number that will be posted at www.virtualshareholdermeeting.com/TOON2023.

Who May Vote?

Only stockholders of record who owned our Common Stock at 5:00 p.m., Pacific Standard Time, on June 27, 2023 (the “Record Date”) will be entitled to vote at the Annual Meeting. On the Record Date, there were 33,935,496 shares of Common Stock outstanding and entitled to vote at the Annual Meeting. Our Common Stock is our only class of voting stock.

If on the Record Date your shares of Common Stock are registered directly in your name with our transfer agent, VStock Transfer LLC, then you are a stockholder of record.

If on the Record Date your shares are held not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice shall be forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a legal proxy from your broker or other agent authorizing you to vote your shares when you register for the Annual Meeting.

You do not need to attend the Annual Meeting to vote your shares. Shares represented by valid proxies, received in time for the Annual Meeting and not revoked prior to the Annual Meeting will be voted at the Annual Meeting. For instructions on how to change or revoke your proxy, see “May I Change or Revoke My Proxy?” below.

| 3 |

How Many Votes Do I Have?

Each share of our Common Stock that you own entitles you to one vote.

Whether you plan to attend the Annual Meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation and are not revoked will be voted in accordance with your instructions on the proxy card or as instructed via Internet. You may specify whether your shares should be voted for or withheld for each nominee for director, and whether your shares should be voted for, against or abstain with respect to each of the other proposals. If you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the recommendations of our board of directors as noted below. Voting by proxy will not affect your right to attend the Annual Meeting. If your shares are registered directly in your name through our stock transfer agent, VStock Transfer LLC, or you have stock certificates registered in your name, you may vote:

| · | By Internet. Follow the instructions included in the Notice or, if you received printed materials, in the proxy card to vote by Internet. | |

| · | By mail. If you received a proxy card by mail, you can vote by mail by completing, signing, dating and returning the proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your shares voted, they will be voted in accordance with the recommendations of our board of directors as noted below. | |

| · | At the Annual Meeting. If you attend the Annual Meeting virtually, you may vote at the Annual Meeting by following the instructions when you log in for the Annual Meeting at www.virtualshareholdermeeting.com/TOON2023. Have your proxy card or Notice in hand as you will be prompted to enter your 16-digit control number to vote at the Annual Meeting. Electronic entry to the Annual Meeting will begin 15 minutes before the start of the meeting. |

Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m., Eastern Daylight Time on August 24, 2023. Telephone and Internet voting facilities for beneficial holders will be available 24 hours a day and will close at 11:59 p.m. Eastern Daylight Time on August 24, 2023.

If your shares are held in “street name” (held in the name of a bank, broker or other holder of record), you will receive instructions from the holder of record. You must follow the instructions of the holder of record in order for your shares to be voted. Telephone and Internet voting also will be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you would like to vote your shares at the Annual Meeting, you should contact your broker or agent to obtain a legal proxy authorizing you to vote your shares when you register for the Annual Meeting.

| 4 |

How Does Our Board of Directors Recommend that I Vote on the Proposals?

Our board of directors recommends that you vote as follows:

| · | “FOR” the election of each of the nominees for director (Proposal 1); | |

| · | “FOR” the ratification of the appointment of Baker Tilly US, LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2023 (Proposal 2); | |

| · | “FOR” the approval of the proposal to change the Company’s state of incorporation from Nevada to Delaware (Proposal 3); | |

| · | “FOR” the approval of, on an advisory basis, the compensation of our named executive officers, as disclosed in this proxy statement (Proposal 4); | |

| · | “FOR” the approval of, on an advisory basis, the frequency of holding an advisory vote on compensation of our named executive officers every three years (Proposal 5); | |

| · | “FOR” the proposal to adjourn the Annual Meeting to solicit additional proxies if there are insufficient votes at the time of the meeting to adopt Proposals 3 and/or 7 (Proposal 6). | |

| · | “FOR” the approval of the proposed amendment to our Articles of Incorporation to increase our authorized shares of Common Stock from 40,000,000 shares to 190,000,000 shares with a corresponding increase in the total number of authorized shares of capital stock of the Company from 50,000,000 shares to 200,000,000 shares (Proposal 7); and | |

| · | “FOR” the approval of the proposal to approve, in accordance with Section 713(A) of the NYSE American Company Guide, the issuance of more than 19.99% of our outstanding Common Stock upon the exercise of certain common stock purchase warrants (Proposal 8). |

If any other matter is presented at the Annual Meeting, your proxy provides that your shares will be voted by the proxy holder listed in the proxy in accordance with his or her best judgment. At the time this proxy statement was first made available, we knew of no matters that needed to be acted on at the Annual Meeting, other than those discussed in this proxy statement.

May I Change or Revoke My Proxy?

If you give us your proxy, you may change or revoke it at any time before the Annual Meeting. You may change or revoke your proxy in any one of the following ways:

| · | if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above; | |

| · | by re-voting by Internet as instructed above; | |

| · | by notifying Kartoon Studios, Inc.’s Corporate Secretary in writing before the Annual Meeting that you have revoked your proxy; or | |

| · | by attending the Annual Meeting virtually and voting online. Attending the Annual Meeting will not in and of itself revoke a previously submitted proxy. You must specifically vote your shares online at the Annual Meeting to revoke your previously submitted proxy. |

Your most current vote, whether by telephone, Internet or proxy card, is the one that will be counted.

| 5 |

What if I Receive More Than One Notice or Proxy Card?

You may receive more than one Notice or proxy card if you hold shares of our Common Stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described above under “How Do I Vote?” for each account to ensure that all of your shares are voted.

Will My Shares be Voted if I Do Not Vote?

If your shares are registered in your name or if you have stock certificates, they will not be counted if you do not vote as described above under “How Do I Vote?” If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above, the bank, broker or other nominee that holds your shares has the authority to vote your unvoted shares only on matters that are deemed “routine,” such as the proposal to ratify the appointment of the auditors. Therefore, we encourage you to provide voting instructions to your bank, broker or other nominee. This ensures your shares will be voted at the Annual Meeting and in the manner you desire. A “broker non-vote” will occur if your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter or because your broker chooses not to vote on a matter for which it does have discretionary voting authority.

What Vote is Required to Approve Each Proposal and How are Votes Counted?

| Proposal 1: Elect Directors | The nominees for director who receive the most votes (also known as a “plurality” of the votes cast) will be elected. You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one or more of the nominees. Votes that are withheld will not be included in the vote tally for the election of the directors. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of the directors. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. | |

| Proposal 2: Ratify Appointment of Independent Registered Public Accounting Firm | The affirmative vote of a majority of the shares cast affirmatively or negatively for this proposal is required to ratify the appointment of our independent registered public accounting firm. Abstentions will have no effect on the results of this vote. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. We are not required to obtain the approval of our stockholders to select our independent registered public accounting firm. However, if our stockholders do not ratify the appointment of Baker Tilly US, LLP as our independent registered public accounting firm for 2023, the Audit Committee of our board of directors will reconsider its selection. | |

| Proposal 3: Approve the Proposal to change the Company’s State of Incorporation from Nevada to Delaware | The affirmative vote of a majority of our total issued and outstanding voting capital stock is required to approve the proposed change to the Company’s state of incorporation from Nevada to Delaware. Abstentions will be treated as votes against this proposal. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Broker non-votes will have the same effect as a vote against this proposal. | |

| 6 |

| Proposal 4: Approve an Advisory Vote on the Compensation of our Named Executive Officers | The affirmative vote of a majority of the shares cast affirmatively or negatively for this proposal is required to approve, on an advisory basis, the compensation of our named executive officers, as described in this proxy statement. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. Although the advisory vote is non-binding, the Compensation Committee and the board of directors will review the voting results and take them into consideration when making future decisions regarding executive compensation. | |

| Proposal 5: Approve an Advisory Vote on the Frequency of Holding an Advisory Vote on the Compensation of our Named Executive Officers | The frequency of holding future advisory votes on the compensation of our named executive officers — every year, every two years or every three years — receiving the greatest number of votes will be the frequency approved, on an advisory basis, by our stockholders. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. Although the advisory vote is non-binding, the Compensation Committee and the board of directors will review the voting results and take them into consideration when determining the frequency of holding future advisory votes on the compensation of our named executive officers. | |

| Proposal 6: Approve the Proposal to Adjourn the Annual Meeting to Solicit Additional Proxies if There Are Insufficient Votes at the Time of the Meeting to Adopt Proposals 3 and/or 7 | The affirmative vote of a majority of the shares cast affirmatively or negatively for this proposal is required to approve the proposal to adjourn the Annual Meeting to solicit additional proxies if there are insufficient votes at the time of the meeting to adopt Proposals 3 and/or 7. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. | |

| Proposal 7: Approve the Proposed Amendment to Our Articles of Incorporation to Increase Our Authorized Shares of Common Stock from 40,000,000 Shares to 190,000,000 Shares with a Corresponding Increase in the Total Number of Authorized Shares of Capital Stock of the Company from 50,000,000 Shares to 200,000,000 Shares | The affirmative vote of a majority of our total issued and outstanding voting capital stock is required to approve the amendment to our Articles of Incorporation to increase our authorized shares of Common Stock from 40,000,000 to 190,000,000 with a corresponding increase in the total number of authorized shares of capital stock of the Company from 50,000,000 shares to 200,000,000 shares. Abstentions will be treated as votes against this proposal. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Broker non-votes will have the same effect as a vote against this proposal. | |

| Proposal 8: Approve, in Accordance with Section 713(A) of the NYSE American Company Guide, the Issuance of More than 19.99% of Our Outstanding Common Stock upon the Exercise of Certain Common Stock Purchase Warrants | The affirmative vote of a majority of the shares cast affirmatively or negatively for this proposal is required to approve this proposal. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

| 7 |

Is Voting Confidential?

We will keep all the proxies, ballots and voting tabulations private. We only let our inspectors of election, VStock Transfer LLC, examine these documents. Management will not know how you voted on a specific proposal unless it is necessary to meet legal requirements. We will, however, forward to management any written comments you make on the proxy card or otherwise provide.

Where Can I Find the Voting Results of the Annual Meeting?

The preliminary voting results will be announced at the Annual Meeting, and we will publish preliminary, or final results if available, in a Current Report on Form 8-K within four business days of the Annual Meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended Current Report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

What Are the Costs of Soliciting these Proxies?

We will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone, fax or email. We will not pay these directors and employees any additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses.

We have engaged Morrow Sodali LLC (“Morrow”) to act as our proxy solicitor in connection with the proposals to be acted upon at the Annual Meeting. For such services, we will pay Morrow an estimated fee of $50,000 plus reasonable expenses.

What Constitutes a Quorum for the Annual Meeting?

The presence, in person or by proxy, of the holders of a majority of the voting power of all outstanding shares entitled to vote at the Annual Meeting is necessary to constitute a quorum for the Annual Meeting. Votes of stockholders of record who are present at the Annual Meeting in person or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.

Attending the Annual Meeting

The Annual Meeting will be held at 10:00 a.m., Pacific Standard Time, on Friday, August 25, 2023, solely by means of remote communication via a live webcast accessible at www.virtualshareholdermeeting.com/TOON2023.

All stockholders may attend the Annual Meeting. For stockholders who plan to attend the Annual Meeting, you must register at www.proxyvote.com by 11:59 p.m., Pacific Standard Time, on Friday, August 18, 2023 (the “Registration Deadline”), as described in your Notice, proxy card, or voting instruction form. As part of the registration process, you must enter the 16-digit control number shown on your Notice, proxy card, or voting instruction form. After completion of your registration by the Registration Deadline, a confirmation email with information on how to attend the Annual Meeting will be emailed to you.

You need not attend the Annual Meeting in order to vote.

| 8 |

Householding of Annual Disclosure Documents

SEC rules concerning the delivery of annual disclosure documents allow us or your broker to send a single Notice or, if applicable, a single set of our proxy materials to any household at which two or more of our stockholders reside, if we or your broker believe that the stockholders are members of the same family. This practice, referred to as “householding,” benefits both you and us. It reduces the volume of duplicate information received at your household and helps to reduce our expenses. The rule applies to our Notices, annual reports, proxy statements and information statements. Once you receive notice from your broker or from us that communications to your address will be “householded,” the practice will continue until you are otherwise notified or until you revoke your consent to the practice. Stockholders who participate in householding will continue to have access to and utilize separate proxy voting instructions.

If your household received a single Notice or, if applicable, a single set of proxy materials this year, but you would prefer to receive your own copy, please contact our transfer agent, VStock Transfer LLC, by calling their toll-free number, 1-855-987-8625.

If you do not wish to participate in “householding” and would like to receive your own Notice or, if applicable, set of the Company’s proxy materials in future years, follow the instructions described below. Conversely, if you share an address with another Company stockholder and together both of you would like to receive only a single Notice or, if applicable, set of proxy materials, follow these instructions:

If your Company shares are registered in your own name, please contact our transfer agent, VStock Transfer LLC, and inform them of your request by calling them at 1-855-987-8625 or writing them at VStock Transfer LLC, 18 Lafayette Place, Woodmere, NY 11598. If a broker or other nominee holds your Company shares, please contact the broker or other nominee directly and inform them of your request.

Electronic Delivery of Company Stockholder Communications

Most stockholders can elect to view or receive copies of future proxy materials over the Internet instead of receiving paper copies in the mail.

You can choose this option and save the Company the cost of producing and mailing these documents by:

| · | following the instructions provided on your Notice or proxy card; or | |

| · | following the instructions provided when you vote over the Internet at www.vstocktransfer com/proxy. |

| 9 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows the beneficial ownership of shares of our Common Stock as of June 27, 2023, known by us through our transfer agent and other records, held by: (i) each person who beneficially owns 5% or more of the shares of Common Stock then outstanding; (ii) each of our directors; (iii) each of our named executive officers; and (iv) all of our current directors and executive officers as a group.

The information in this table reflects “beneficial ownership” as defined in Rule 13d-3 of the Exchange Act. To our knowledge and unless otherwise indicated, each stockholder has sole voting power and investment power over the shares listed as beneficially owned by such stockholder, subject to community property laws where applicable. Percentage ownership is based on 33,935,496 shares of Common Stock outstanding as of June 27, 2023. Unless otherwise indicated in the footnotes to the following table, each person named in the table has sole voting and investment power and that person’s address is c/o 190 N. Canon Drive, 4th Floor, Beverly Hills, CA 90210.

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership (1) |

Percent of Class (1) | |||

| Directors and Named Executive Officers | |||||

| Andy Heyward | 3,103,901 | (2) | 9.01% | ||

| Michael Jaffa | 114,836 | (3) | * | ||

| Robert L. Denton | 108,800 | (4) | * | ||

| Michael Hirsh | 185,439 | (5) | * | ||

| Anthony Thomopoulos | 7,042 | (6) | * | ||

| Joseph (Gray) Davis | 7,030 | (7) | * | ||

| Margaret Loesch | 7,030 | (7) | * | ||

| Lynne Segall | 7,030 | (7) | * | ||

| Henry Sicignano III | 0 | * | |||

| Dr. Cynthia Turner-Graham | 7,530 | (8) | * | ||

| Stefan Piëch | 348,127 | (9) | 1.03% | ||

| All current executive officers and directors as a group (consisting of 11 persons) | 3,896,764 | 11.21% | |||

_______________________

*Indicates ownership less than 1%

| (1) | Applicable percentage ownership is based on 33,935,496 shares of Common Stock outstanding as of June 27, 2023, together with securities exercisable or convertible into shares of Common Stock within 60 days of June 27, 2023. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of Common Stock that a person has the right to acquire beneficial ownership of upon the exercise or conversion of options, convertible stock, warrants or other securities that are currently exercisable or convertible or that will become exercisable or convertible within 60 days of June 27, 2023 are deemed to be beneficially owned by the person holding such securities for the purpose of computing the number of shares beneficially owned and percentage of ownership of such person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. |

| (2) | Consists of (i) 99,073 shares of Common Stock held by A Squared Holdings LLC over which Mr. Heyward holds sole voting and dispositive power; (ii) 2,246,889 shares of Common Stock held by Mr. Heyward or issuable upon vested RSUs; (iii) 257,816 shares of Common Stock held by AH Gadget IDF LLC an entity controlled by Mr. Heyward (iv) 123 shares held by Heyward Living Trust; (v) 500,000 options to acquire shares of Common Stock issuable upon the exercise of stock options. that will become exercisable within 60 days of June 27, 2023. |

| 10 |

| (3) | Consists of 33,336 shares of Common Stock held by Mr. Jaffa or issuable upon vested RSUs; and 81,500 shares of Common Stock issuable upon exercise of stock options granted to Mr. Jaffa, that will become exercisable within 60 days of June 27, 2023. |

| (4) | Consists of 31,300 shares of Common Stock held by Mr. Denton or issuable upon vested RSUs and 77,500 shares of Common Stock issuable upon exercise of stock options granted to Mr. Denton, that will become exercisable within 60 days of June 27, 2023. |

| (5) | Consists of 42,835 shares of Common Stock, 67,667 shares of Exchangeable shares, exchangeable into shares of Common Stock and 74,937 shares issuable upon exercise of stock options granted to Mr. Hirsh that will become exercisable within 60 days of June 27, 2023. |

| (6) | Consists of 5,042 shares of Common Stock held and 2,000 shares of Common Stock issuable upon exercise of stock options granted to Mr. Thomopoulos that will become exercisable within 60 days of June 27, 2023. |

| (7) | Consists of 5,030 shares of Common Stock held and 2,000 shares of Common Stock issuable upon exercise of stock options granted to each of these directors that will become exercisable within 60 days of June 27, 2023. |

| (8) | Consists of 5,530 shares of Common Stock held and 2,000 shares of Common Stock issuable upon exercise of stock options granted to Dr. Turner-Graham that will become exercisable within 60 days of June 27, 2023. |

| (9) | Consists of 348,127 shares of Common Stock held by Mr. Piëch. |

| 11 |

MANAGEMENT AND CORPORATE GOVERNANCE

Our Board of Directors

Our Bylaws provide that our business is to be managed by or under the direction of our board of directors. Our board of directors are elected at each annual meeting of the stockholders to hold office until the next annual meeting.

On June 16, 2023, our board of directors accepted the recommendation of the Nominating Committee and voted to nominate the names set forth below for election at the Annual Meeting to serve for a term until the 2024 annual meeting of stockholders, and until their respective successors have been elected and qualified, or until the death, resignation, or removal of any director pursuant to the Bylaws.

Set forth below are the names of the persons nominated for election as directors, their ages as of July 14, 2023, their offices in the Company, if any, their principal occupations or employment for at least the past five years, the length of their tenure as directors and the names of other public companies in which such persons hold or have held directorships during the past five years. Additionally, information about the specific experience, qualifications, attributes or skills that led to our board of directors’ conclusion at the time of filing of this proxy statement that each person listed below should serve as a director is set forth below:

| Name | Age | Position | ||

| Andy Heyward | 74 | Chief Executive Officer and Chairman of the Board of Directors | ||

| Joseph “Gray” Davis * | 80 | Director | ||

| Michael Hirsh | 75 | Director | ||

| Margaret Loesch* | 77 | Director | ||

| Stefan Piëch | 52 | Director | ||

| Lynne Segall* | 70 | Director | ||

| Henry Sicignano III * | 55 | Director | ||

| Anthony Thomopoulos * | 85 | Director | ||

| Dr. Cynthia Turner-Graham * | 69 | Director |

* Denotes directors who are “independent” under applicable SEC and NYSE American rules.

Our board of directors has reviewed the materiality of any relationship that each of our directors has with the Company, either directly or indirectly. Based upon this review, our board of directors has determined that the following members of the board of directors are “independent directors” as defined by the NYSE American Company Guide: Gov. Davis, Messrs. Sicignano III and Thomopoulos, Mses. Loesch and Segall and Dr. Turner-Graham.

Andy Heyward, 74, has been the Company’s Chief Executive Officer since November 2013 and the Company’s Chairman of the Board since December 2013. Mr. Heyward co-founded DIC Animation City in 1983 and served as its Chief Executive Officer until its sale in 1993 to Capital Cities/ ABC, Inc., which was eventually bought by The Walt Disney Company in 1995. Mr. Heyward ran the company while it was owned by The Walt Disney Company until 2000 when Mr. Heyward purchased DIC Entertainment L.P. and DIC Productions L.P. corporate successors to the DIC Animation City business, with the assistance of Bain Capital and served as the Chairman and Chief Executive Officer of their acquiring company DIC Entertainment Corporation, until he took the company public on the AIM. He sold the company in 2008. Mr. Heyward co-founded A Squared Entertainment LLC in 2009 and has served as its Co-President since inception. Mr. Heyward earned a Bachelor of Arts degree in Philosophy from UCLA and is a member of the Producers Guild of America, the National Academy of Television Arts and the Paley Center (formerly the Museum of Television and Radio). Mr. Heyward gave the Commencement address in 2011 for the UCLA College of Humanities and was awarded the 2002 UCLA Alumni Association’s Professional Achievement Award. He has received multiple Emmys and other awards for Children’s Entertainment. He serves on the board of directors of the Cedars Sinai Medical Center. Mr. Heyward has produced over 5,000 half hour episodes of award-winning entertainment, among them Inspector Gadget; The Real Ghostbusters; Strawberry Shortcake; Care Bears; Alvin and the Chipmunks; Hello Kitty’s Furry Tale Theater; The Super Mario Brothers Super Show; The Adventures of Sonic the Hedgehog; Sabrina The Animated Series; Captain Planet and the Planeteers; Liberty’s Kids, and many others. Mr. Heyward was chosen as a director because of his extensive experience in children’s entertainment and as co-founder of A Squared Entertainment.

| 12 |

Joseph “Gray” Davis, 80, has been a director of the Company since December 2013. Mr. Davis served as the 37th governor of California from 1998 until 2003. Mr. Davis currently serves as “Of Counsel” in the Los Angeles, California office of Loeb & Loeb LLP. Mr. Davis has served on the board of directors of DIC Entertainment and is a member of the bipartisan Think Long Committee, a Senior Fellow at the UCLA School of Public Affairs and Co-Chair of the Southern California Leadership Counsel. Mr. Davis received his undergraduate degree from Stanford University and received his Juris Doctorate from Columbia Law School. Mr. Davis served as lieutenant governor of California from 1995-1998, California State Controller from 1987-1995 and California State Assemblyman from 1982-1986. Mr. Davis was chosen as a director of the Company based on his knowledge of corporate governance.

Michael Hirsh, 75, has been a director of the Company since 2022 and has served as Chief Executive Officer of Mainframe Studios, a Canadian-related entity of the Company, since April 2022. Mr. Hirsh served as Chief Executive Officer from December 2016 until April 2022, when the Company acquired Wow. Prior to Wow, Mr. Hirsh founded and was CEO of Cookie Jar, which he merged with DHX Media (now Wild Brain), where he served as Executive Chairman from 2012 to 2015. Mr. Hirsh was also a co-founder and CEO of Nelvana from 1971 to 2002 where he developed and produced numerous award-winning productions including, The Magic School Bus, Care Bears, Babar, Rupert, Beetlejuice, The Adventures of Tintin and created the first Star Wars animated series with George Lucas. Mr. Hirsh has won Daytime Emmy Awards, Gemini Awards, the Joe Shuster Award and a Golden Reel Award. Mr. Hirsh was chosen as a director of the Company based on his experience launching hit productions including the first Star Wars animated programs, The Magic School Bus, Care Bears and Beetlejuice.

Margaret Loesch, 77, has been the Executive Chairman of the Kartoon Channel! since June 2020, a Director of the Company since March 2015 and the Executive Chairman of the Toon Media Networks since December 2016. Beginning in 2009 through 2014, Ms. Loesch, served as Chief Executive Officer and President of The Hub Network, a cable channel for children and families, including animated features. The Company has, in the past, provided The Hub Network with certain children’s programming. From 2003 through 2009 Ms. Loesch served as Co-Chief Executive Officer of The Hatchery, a family entertainment and consumer product company. From 1998 through 2001 Ms. Loesch served as Chief Executive Officer of the Hallmark Channel, a family related cable channel. From 1990 through 1997 Ms. Loesch served as the Chief Executive Officer of Fox Kids Network, a children’s programming block and from 1984 through 1990 served as the Chief Executive Officer of Marvel Productions, a television and film studio subsidiary of Marvel Entertainment Group. Ms. Loesch obtained her Bachelor of Science from the University of Southern Mississippi. Ms. Loesch was chosen to be a director based on her 40 years of experience at the helm of major children and family programming and consumer product channels.

Dr. Stefan Piëch, 52, has been a director of the Company since June 23, 2022. Since October 2006, Dr. Stefan Piëch has served as Chief Executive Officer of Your Family Entertainment AG (“YFE”) and Managing Partner of F&M Film und Medien Beteiligungs GmbH (“F&M”) since 2005. Mr. Piëch was a founding member and the CEO of Openpictures AG from 2000 to 2005. Mr. Piëch also serves on the board of several companies, including on the supervisory board of SEAT S.A. since 2015, on the supervisory board of Porsche Automobil Holding SE since 2018, on the supervisory board of Siemens Aktiengesellschaft Österreich since 2020 and is Member of the board of the German Chamber of Commerce in Austria since 2020. Mr. Piëch obtained his Bachelor of Arts degree in Film & Media from the University of Stirling and his Ph.D. in Media from the University of Klagenfurt. Mr. Piëch was chosen to be a director based on his experience with YFE and his deep expertise in creating children’s content.

Lynne Segall, 70, has been a director of the Company since December 2013. Ms. Segall has served as the Senior Vice President and Publisher of The Hollywood Reporter since June 2011. From 2010 to 2011, Ms. Segall was the Senior Vice President of Deadline Hollywood. From June 2006 to May 2010, Ms. Segall served as the Vice President of Entertainment, Fashion & Luxury advertising at the Los Angeles Times. In 2005, Ms. Segall received the Women of Achievement Award from The Hollywood Chamber of Commerce and the Women in Excellence Award from the Century City Chamber of Commerce. In 2006, Ms. Segall was recognized by the National Association of Women with its Excellence in Media Award. Ms. Segall was chosen to be a director based on her expertise in the entertainment industry.

Henry Sicignano III, 55, has been a director of the Company since May 2023. Mr. Sicignano currently serves as the President of Charlie's Holdings, Inc., a publicly traded consumer goods company with a global presence spanning more than 90 countries, where he has successfully expanded the company's product line, intellectual property portfolio, and revenue base. Prior to this role at Charlie’s Holdings, Inc., from April 2015 to July 2019, he served as the Chief Executive Officer, President and Director at 22nd Century Group, Inc., a publicly listed plant biotechnology firm, where he played a pivotal role in dramatically increasing the company's sales and market cap. From April 2010 to March 2015 he served as President and Director of 22nd Century. Mr. Sicignano also served as the General Manager at NOCO Energy Corp from August 2005 to April 2009, Vice President at Kittinger Furniture Company, Inc. from March 2003 to July 2005, and as a director at Anandia Laboratories, Inc. (acquired in 2018), from December 2014 to August 2018. Mr. Sicignano has consistently demonstrated a deep understanding of strategic planning, operational efficiency, P&L management, and capital markets. He holds both a B.A. degree from Harvard College and an M.B.A. degree from Harvard University. Mr. Sicignano was chosen to be a director of the Company based on his success as an executive with multiple public companies, his extensive contacts within the investment community, and his financial expertise.

| 13 |

Anthony Thomopoulos, 85, has been a director of the Company since February 2014. Mr. Thomopoulos served as the Chairman of United Artist Pictures from 1986 to 1989 and formed Thomopoulos Pictures, an independent production company of both motion pictures and television programs in 1989 and has served as its Chief Executive Officer since 1989. From 1991 to 1995, Mr. Thomopoulos was the President of Amblin Television, a division of Amblin Entertainment. Mr. Thomopoulos served as the President of International Family Entertainment, Inc. from 1995 to 1997. From June 2001 to January 2004, Mr. Thomopoulos served as the Chairman and Chief Executive Officer of Media Arts Group, a NYSE listed company. Mr. Thomopoulos served as a state commissioner of the California Service Corps. under Governor Schwarzenegger from 2005 to 2008. Mr. Thomopoulos is also a founding partner of Morning Light Productions. Since he founded it in 2008, Mr. Thomopoulos has operated Thomopoulos Productions and has served as a consultant to BKSems, USA, a digital signage company. Mr. Thomopoulos is an advisor and a member of the National Hellenic Society and holds a degree in Foreign Service from Georgetown University and sat on its Board of Directors from 1978 to 1988. Mr. Thomopoulos was chosen as a director of the Company based on his entertainment industry experience.

Dr. Cynthia Turner-Graham, 69, has been a director of the Company since June 2021. Dr. Turner-Graham is a board-certified psychiatrist and Distinguished Life Fellow of the American Psychiatric Association, who brings over 40 years of experience in the healthcare industry as a practicing psychiatrist, healthcare administrator and community leader. Since 1988, Dr. Turner-Graham has been a practicing psychiatrist at an outpatient psychiatry practice. Since 2004, Dr. Turner-Graham has served as President and Chief Executive Officer of ForSoundMind Enterprises, Inc., a provider of outpatient psychiatric services and developer of educational workshop experiences focused on promotion of emotional and mental health. From February 2014 until November 2019, she served as Medical Director for Inner City Family Services in Washington, DC. Among her accomplishments, Dr. Turner-Graham is the immediate past president of the Suburban Maryland Psychiatric Society, served as a Director of the Washington Psychiatric Society and has taken the helm of Black Psychiatrists of America, Inc. She has previously served as Clinical Assistant Professor of Psychiatry at both Vanderbilt University and Howard University Schools of Medicine. Dr. Turner-Graham was chosen as a director of the Company based on her career as a distinguished psychiatrist and her expertise with children.

Diversity

The Board Diversity Matrix, below, provides the diversity statistics for our board of directors.

|

Board Diversity Matrix for Kartoon Studios, Inc. As of July 14, 2023 | ||||||||||||||

| Total Number of Directors | 9 | |||||||||||||

| Female | Male | Non-Binary |

Did Not Disclose Gender |

|||||||||||

| Part I: Gender Identity | ||||||||||||||

| Directors | 3 | 6 | — | |||||||||||

| Part II: Demographic Background | ||||||||||||||

| African American or Black | 1 | — | — | — | ||||||||||

| Alaskan Native or Native American | — | — | — | — | ||||||||||

| Asian | — | — | — | — | ||||||||||

| Hispanic or Latinx | — | — | — | — | ||||||||||

| Native Hawaiian or Pacific Islander | — | — | — | — | ||||||||||

| White | 2 | 6 | — | — | ||||||||||

| Two or More Races or Ethnicities | — | — | — | — | ||||||||||

| LGBTQ+ | 1 | |||||||||||||

| Did Not Disclose Demographic Background | 0 | |||||||||||||

| 14 |

Family Relationships

There are no family relationships between any of our directors and our executive officers.

Board Leadership Structure and Role in Risk Oversight

The board of directors has responsibility for establishing broad corporate policies and reviewing our overall performance rather than day-to-day operations. The primary responsibility of our board of directors is to oversee the management of our company and, in doing so, serve the best interests of the Company and our stockholders. The board of directors selects, evaluates and provides for the succession of executive officers and, subject to stockholder election, directors. It reviews and approves corporate objectives and strategies and evaluates significant policies and proposed major commitments of corporate resources. Our board of directors also participates in decisions that have a potential major economic impact on the Company. Management keeps the directors informed of company activity through regular communication, including written reports and presentations at board of directors and committee meetings.

Although we have not adopted a formal policy on whether the Chairman and Chief Executive Officer positions should be separate or combined, we have traditionally determined that it is in the best interest of the Company and its stockholders to combine these roles. Due to the small size of the Company, we believe it is currently most effective to have the Chairman and Chief Executive Officers positions combined.

The Company currently has nine directors, including Mr. Heyward, its Chairman, who also serves as the Company’s Chief Executive Officer. The Chairman and the board of directors are actively involved in the oversight of the Company’s day to day activities.

Hedging

Our Insider Trading Policy provides that no employee may acquire, sell or trade in any interest or position relating to the future price of Company securities, such as a put option, a call option or a short sale (including a short sale “against the box”).

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our officers, directors and any persons who own more than 10% of our Common Stock to file reports of ownership of, and transactions in, our Common Stock with the SEC and furnish copies of such reports to us. Based solely on our reviews of the copies of such forms and amendments thereto furnished to us and on written representations from officers, directors, and any other person whom we understand owns more than 10% or our Common Stock, we found that during 2022, all Section 16(a) filings were made with the SEC on a timely basis except that one Form 3 was filed late by Dr. Piëch, one Form 3 was filed late by Mr. Hirsh, one Form 4 covering two transactions was filed late by Mr. Hirsh and one Form 4 covering two transactions was filed late by Mr. Hirsh.

Committees of the Board of Directors and Meetings

During the fiscal year ended December 31, 2022, our board of directors held four meetings. No director attended fewer than 75% of the total number of meetings of our board of directors and of committees of our board of directors on which he or she served during the fiscal year ended December 31, 2022.

| 15 |

The following table sets forth the four standing committees of our board of directors and the members of each committee and the number of meetings held by our board of directors and the committees during 2022:

| Director | Board |

Audit Committee |

Compensation Committee |

Nominating Committee |

Investment Committee | |||||

| Andy Heyward | Chair | |||||||||

| Joseph “Gray” Davis (1) | X | X | X | X | ||||||

| Michael Hirsh (2) | X | |||||||||

| Margaret Loesch | X | X | ||||||||

| Dr. Stefan Piëch (2) | X | |||||||||

| Lynne Segall (3) | X | X | Chair | Chair | ||||||

| Henry Sicignano III (4) | X | Chair | X | |||||||

| Anthony Thomopoulos (1) | Vice Chair | |||||||||

| Dr. Cynthia Turner-Graham | X | |||||||||

| Meetings in 2022: | 4 | 4 | 2 | 1 | 2 |

__________________

| (1) | Effective September 1, 2022, Joseph “Gray” Davis replaced Anthony Thomopoulos on the Audit Committee. | |

| (2) | Effective June 23, 2022, Michael Hirsh and Dr. Stefan Piëch were elected as members of our board of directors. | |

| (3) | Effective July 18, 2022, Lynne Segall replaced Michael Klein on the Audit Committee. | |

| (4) | Effective May 22, 2023, Henry Sicignano III replaced P. Clark Hallren as a member of our board of directors, as chair of the Audit Committee, and as a member of the Investment Committee. |

The board of Directors has adopted a policy under which each member of the board of directors makes every effort, but is not required, to attend each annual meeting of our stockholders.

To assist it in carrying out its duties, the board of directors has delegated certain authority to the Audit Committee, the Compensation Committee, the Nominating Committee and the Investment Committee as the functions of each are described below.

Audit Committee

Messrs. Davis and Sicignano III and Ms. Segall serve on our Audit Committee. Our Audit Committee’s main function is to oversee our accounting and financial reporting processes, internal systems of control, independent auditor relationships and the audits of our financial statements. The Audit Committee’s responsibilities include:

| · | selecting, hiring, and compensating our independent auditors; | |

| · | evaluating the qualifications, independence and performance of our independent auditors; | |

| · | overseeing and monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters; | |

| · | approving the audit and non-audit services to be performed by our independent auditor; | |

| · | reviewing with the independent auditor the design, implementation, adequacy and effectiveness of our internal controls and our critical accounting policies; and | |

| · | preparing the report that the SEC requires in our annual proxy statement. |

| 16 |

The board of directors has adopted an Audit Committee charter and the Audit Committee reviews and reassesses the adequacy of the charter on an annual basis. The Audit Committee members meet NYSE American’s financial literacy requirements and are independent under applicable SEC and NYSE American rules, and the board of directors has further determined that Mr. Sicignano III (i) is an “audit committee financial expert” as such term is defined in Item 407(d) of Regulation S-K promulgated by the SEC and (ii) also meets NYSE American’s financial sophistication requirements.

A copy of the Audit Committee’s written charter is publicly available on our website at www.kartoonstudios.com.

Compensation Committee

Mses. Segall and Loesch serve on the Compensation Committee and are independent under the applicable NYSE American rules. Our Compensation Committee’s main functions are assisting our board of directors in discharging its responsibilities relating to the compensation of outside directors, the Chief Executive Officer and other executive officers, as well as administering any stock incentive plans we may adopt. The Compensation Committee’s responsibilities include the following:

| · | reviewing and recommending to our board of directors the compensation of our Chief Executive Officer and other executive officers, and the outside directors; | |

| · | conducting a performance review of our Chief Executive Officer; | |

| · | reviewing our compensation policies; and | |

| · | if required, preparing the report of the Compensation Committee for inclusion in our annual proxy statement. |

The board of directors has adopted a Compensation Committee charter and the Compensation Committee reviews and reassesses the adequacy of the charter on an annual basis.

The Compensation Committee’s policy is to offer our executive officers competitive compensation packages that will permit us to attract and retain highly qualified individuals and to motivate and reward these individuals in an appropriate fashion aligned with the long-term interests of our Company and our stockholders.

Compensation Committee Risk Assessment

We have assessed our compensation programs and concluded that our compensation practices do not create risks that are reasonably likely to have a material adverse effect on us.

A copy of the Compensation Committee’s written charter is publicly available on our website at www.kartoonstudios.com.

Nominating Committee

Gov. Davis and Ms. Segall serve on our Nominating Committee. The Nominating Committee’s responsibilities include:

| · | identifying qualified individuals to serve as members of our board of directors; | |

| · | review the qualifications and performance of incumbent directors; | |

| · | review and consider candidates who may be suggested by any director or executive officer or by a stockholder of the Company; and | |

| · | review considerations relating to board composition, including size of the board, term and age limits, and the criteria for membership of the board. |

| 17 |

The board of directors has adopted a Nominating Committee charter and the Nominating Committee reviews and reassesses the adequacy of the charter on an annual basis. For all potential candidates, the Nominating Committee may consider all factors it deems relevant, such as a candidate’s personal integrity and sound judgment, business and professional skills and experience, independence, knowledge of the industry in which we operate, possible conflicts of interest, diversity, the extent to which the candidate would fill a present need on the board of directors, and concern for the long-term interests of our stockholders.

The Nominating Committee considers issues of diversity among its members in identifying and considering nominees for director, and strives, where appropriate, to achieve a diverse balance of backgrounds, perspectives and experience on the board of directors and its committees.

A copy of the Nominating Committee’s written charter is publicly available on our website at www.kartoonstudios.com.

Investment Committee

Messrs. Davis and Sicignano III serve on our Investment Committee. The primary purpose of the Investment Committee is to assist the board of directors in reviewing our investment policy and strategies and in overseeing our capital and financial resources. A material investment on behalf of the Company may not be made without the Investment Committee’s approval or the approval of a delegate of the Investment Committee pursuant to an appropriate delegation of the Investment Committee’s authority. In order to carry out its mission and function, and subject to the terms of the Company’s Articles of Incorporation, the Investment Committee has the authority to:

| · | review the investment policy, strategies, transactions and programs of the Company and its subsidiaries to ensure they are consistent with the goals and objectives of the Company; | |

| · | evaluate and approve or disapprove each proposed material investment on behalf of the Company; | |

| · | determine whether the investment policy is consistently followed and that procedures are in place to ensure that the Company’s investment portfolio is managed in compliance with its policies; | |

| · | review the performance of the investment portfolios of the Company and its subsidiaries; and | |

| · | approve and revise, as appropriate, the Company’s investment policies and guidelines. |

Stockholder Communications to our Board of Directors

Generally, stockholders who have questions or concerns should contact our Investor Relations department at 212-564-4700. However, any stockholders who wish to address questions regarding our business directly with the board of directors, or any individual director, should direct his or her questions in writing to Kartoon Studios, Inc., at 190 N. Canon Drive, 4th Floor, Beverly Hills, California 90210, Attn: Corporate Secretary or by using the “Contact” page of our website www.kartoonstudios.com/contact. Communications will be distributed to the board of directors, or to any individual director or directors as appropriate, depending on the facts and circumstances outlined in the communications. Items that are unrelated to the duties and responsibilities of the board of directors may be excluded, such as:

| · | junk mail and mass mailings; | |

| · | resumes and other forms of job inquiries; | |

| · | surveys; and | |

| · | solicitations or advertisements. |

| 18 |

In addition, any material that is unduly hostile, threatening, or illegal in nature may be excluded, provided that any communication that is filtered out will be made available to any outside director upon request.

Executive Officers

The following table sets forth certain information as of July 14, 2023, regarding our Chief Executive Officer, Andy Heyward, can be found under the caption “The Board of Directors” above.

| Name | Age | Position | ||

| Andy Heyward | 74 | Chief Executive Officer and Chairman of the Board of Directors | ||

| Robert L. Denton | 63 | Chief Financial Officer | ||

| Michael A. Jaffa | 57 | Chief Operating Officer and Corporate Secretary |

Robert Denton, 63, has been the Company’s Chief Financial Officer since March 2022 and previously served as the Company’s Executive Vice President of Finance and Accounting from December 14, 2021 through March 2022 and as Chief Financial Officer from April 2018 through December 13, 2021. He served as the Chief Financial Officer of Atlys, Inc. a next-gen media technology company from 2011 to 2018. He has over 30 years of experience as a financial executive, specifically in the entertainment industry. He began his career in 1982 with Ernst & Young handling filings with the SEC, including initial public offerings. He left Ernst & Young in 1990 to work as Vice President and Chief Accounting Officer for LIVE Entertainment, Inc. In 1996, LIVE was acquired by Artisan Entertainment, Inc., and, in December 2000, Mr. Denton was promoted to Executive Vice President of Finance and CAO. Mr. Denton also served as the COO of Artisan Home Entertainment, where he directed all financial reporting, budgeting and forecasting, manufacturing and distribution of the Home Entertainment Division. Mr. Denton left Artisan at the end of 2003 and joined DIC Entertainment Corporation to serve as their Chief Financial Officer. At DIC, he directed the three-year financial audit, due diligence and preparation of the company’s Admission Documents, and he was responsible for all monthly financial reporting to the Board of Directors as well as the semi-annual reporting to the AIM Exchange of the London Stock Exchange. Mr. Denton left DIC in February 2009 after completing the acquisition and transition of DIC to the Cookie Jar Company. Mr. Denton served as the Chief Financial Officer of Gold Circle Films from 2009 to 2011. From 2009 to 2014, Mr. Denton also owned and operated three Assisted Living Facilities for the Elderly, to help better care for his mother. Mr. Denton is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants and the California Society of Certified Public Accountants.

Michael Jaffa, 57, was promoted to Chief Operating Officer and General Counsel on December 7, 2020. Previously he served as the General Counsel and Corporate Secretary of the Company since April 2018. From January 2017 through April 2018, Mike served as Thoughtful Media Group’s (TMG) General Counsel and Global Head of Business Affairs. TMG is a multichannel network focused on Asian markets. At TMG, Mr. Jaffa oversaw all of TMG’s legal matters, established the framework for TMG’s continued growth in international markets, including a franchise plan, the formation of a regional headquarters in Southeast Asia and assisted with M&A transactions. From September 2013 through December 2016, Mr. Jaffa worked as the Head of Business Affairs for DreamWorks Animation Television, and before that served in a similar role at Hasbro Studios from December 2009 through September 2013. Mr. Jaffa has over 20 years of experience handling licensing, production, merchandising, complex international transactions and employment issues for large and small entertainment companies and technology startups.

| 19 |

EXECUTIVE OFFICER AND DIRECTOR COMPENSATION

This section describes the material elements of compensation awarded to, earned by or paid to each of our named executive officers. Our Compensation Committee will review and approve the compensation of our executive officers and oversee our executive compensation programs and initiatives.

Summary Compensation Table

The following table provides information regarding the total compensation for services rendered in all capacities that was earned during the fiscal year indicated by our named officers for fiscal year 2022 and 2021.

| Name and Principal Position | Year | Salary ($) |

Bonus ($) |

Stock Awards ($) (1) |

Option Awards ($) (1) |

All Other Compensation ($) |

Total ($) | |||||||

| Andy Heyward (2) | 2022 | 440,000 | 220,000 | – | – | 775,000 | 1,435,000 | |||||||

| Chief Executive Officer | 2021 | 440,000 | 212,987 | – | – | 543,750 | 1,196,737 | |||||||

| Michael A. Jaffa (3) | 2022 | 374,871 | 150,000 | – | – | – | 524,871 | |||||||

| Chief Operating Officer, General Counsel and Corporate Secretary | 2021 | 326,326 | 25,000 | – | – | – | 351,326 | |||||||

| Michael Hirsh (4) | 2022 | 323,512 | – | 390,000 | 316,481* | – | 1,029,993 | |||||||

| Chief Executive Officer of Frederator and Mainframe Studios |

______________________

* Excluded from the Option Awards granted to Mr. Hirsh is the fair value ($369,380) of the replacement options granted upon the acquisition of Wow that were previously earned and vested prior to the acquisition.

| (1) | The aggregate fair value of the stock awards and stock option awards on the date of grant was computed in accordance with FASB ASC Topic 718. |

| (2) | Mr. Heyward entered into a five-year employment agreement on December 7, 2020, pursuant to which is entitled to an annual salary of $440,000. |

| During 2022, Mr. Heyward was paid $775,000 in producer fees and earned $220,000 in discretionary bonuses. | |

| (3) | Mr. Jaffa entered into a three-year employment agreement on December 7, 2020. Under his employment agreement, Mr. Jaffa is entitled to an annual salary of $325,000 the first year, $350,000 the second year and $375,000 the third year and an annual signing bonus of $50,000 each year. |

| On December 7, 2020, the Company granted 100,000 stock options to Mr. Jaffa with a strike price of $13.90 and a term of 10 years. 40,000 of the options vested on the grant date with the remaining options vesting 20,000 each of the next three years. On December 7, 2020, the Company also granted 50,000 RSUs to Mr. Jaffa. The RSUs vest 16,667 on the first anniversary, 16,667 on the second anniversary and 16,667 on the third anniversary. | |

| (4) | Effective April 7, 2022, the Company entered into an employment agreement with Mr. Hirsh, whereby Mr. Hirsh agreed to serve as the Chief Executive Officer of the Company’s wholly owned subsidiaries WOW Unlimited Inc. and its subsidiaries Mainframe Studios and Frederator for a period of three years in consideration for an annual salary of $440,000. Mr. Hirsh is also entitled to earn $12,400 as an executive producer fee per 30 minute broadcast episode. In addition, on June 23, 2022, Mr. Hirsh was granted 50,000 RSUs with a fair value of $390,000 and 50,000 options with an exercise price of $7.80 per share, with a fair value of $316,481 on the grant date. The RSUs and options vest 16,666 on the first anniversary, 16,666 on the second anniversary and 16,667 on the third anniversary. |

| 20 |

Narrative Disclosure to Summary Compensation

Base Salary. In 2022, the Company paid $440,000 to Andy Heyward, $374,871 to Michael A. Jaffa and $323,512 to Michael Hirsh. In 2021, the Company paid $440,000 to Mr. Heyward and $326,326 to Mr. Jaffa. Base salaries are used to recognize experience, skills, knowledge and responsibilities required of all of our employees, including our executive officers.

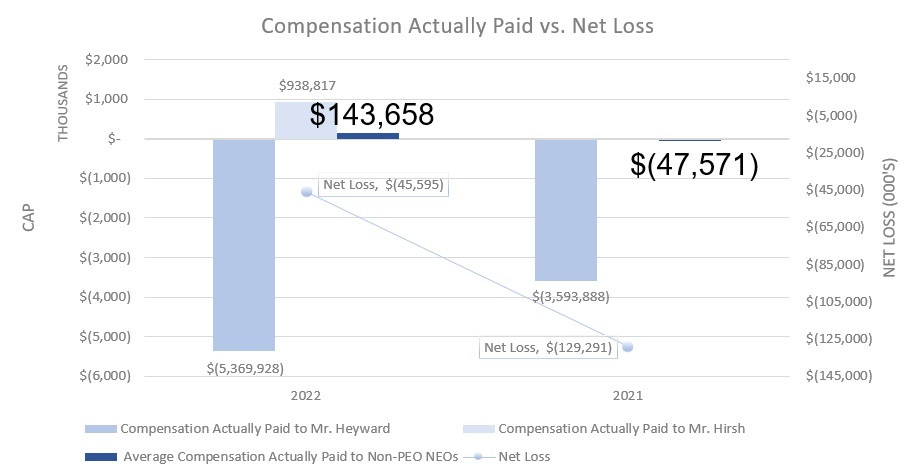

All Other Compensation. Pursuant to his employment agreement dated December 7, 2020, Mr. Heyward is entitled to an Executive Producer fee of $12,500 per one-half hour episode for each episode for which he provides services as an executive producer. During 2022, Mr. Heyward was paid $775,000 in producer fees.