Exhibit 3.1

Business Entity - Filing Acknowledgement 09/25/2023 Work Order Item Number: Filing Number: Filing Type: Filing Date/Time: Filing Page(s): W2023092500938 - 3168446 20233507436 Certificate of Designation 9/25/2023 10:43:00 AM 9 Indexed Entity Information: Entity ID: E0515682011 - 9 Entity Status: Active Entity Name: Kartoon Studios, Inc. Expiration Date: None Commercial Registered Agent PARACORP INCORPORATED 318 N CARSON ST #208, Carson City, NV 89701, USA FRANCISCO V. AGUILAR Secretary of State DEPUTY BAKKEDAHL Deputy Secretary for Commercial Recordings STATE OF NEVADA OFFICE OF THE SECRETARY OF STATE Commercial Recordings Division 401 N. Carson Street Carson City, NV 89701 Telephone (775) 684 - 5708 Fax (775) 684 - 7138 North Las Vegas City Hall 2250 Las Vegas Blvd North, Suite 400 North Las Vegas, NV 89030 Telephone (702) 486 - 2880 Fax (702) 486 - 2888 The attached document(s) were filed with the Nevada Secretary of State, Commercial Recording Division. The filing date and time have been affixed to each document, indicating the date and time of filing. A filing number is also affixed and can be used to reference this document in the future. Respectfully, FRANCISCO V. AGUILAR Secretary of State Page 1 of 1 Commercial Recording Division 401 N. Carson Street

| 1 |

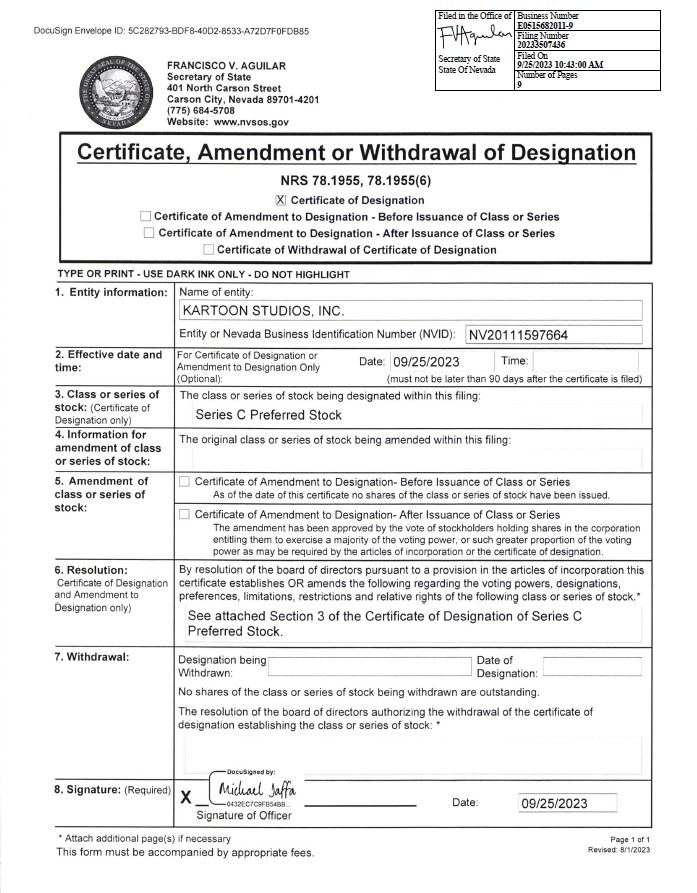

Business Number E0515682011 - 9 Filed in the Office of Secretary of State State Of Nevada Filing Number 20233507436 Filed On 9/25/2023 10:43:00 AM Number of Pages 9

| 2 |

KARTOON STUDIOS, INC.

CERTIFICATE OF DESIGNATION

OF

SERIES C PREFERRED STOCK

I, Michael Jaffa, hereby certify that I am the Chief Operating Officer, General Counsel and Corporate Secretary of Kartoon Studios, Inc. (the “Corporation”), a corporation incorporated and existing under Chapter 78 of the Nevada Revised Statues (the “Nevada Private Corporations Law” or the “NRS”), and further do hereby certify that, pursuant to the authority expressly conferred upon the board of directors of the Corporation (the “Board of Directors”) by the Corporation’s Articles of Incorporation, as amended (the “Articles of Incorporation”), the Board of Directors on September 21, 2023 adopted the following resolutions creating a series of shares of Preferred Stock designated as Series C Preferred Stock, none of which shares have been issued:

WHEREAS, the Articles of Incorporation provides for a class of capital stock of the Corporation known as preferred stock, consisting of 10,000,000 shares, par value $0.001 per share (the “Preferred Stock”), issuable from time to time in one or more series,

WHEREAS, the Articles of Incorporation further provides that the Board of Directors is expressly authorized, subject to limitations prescribed by law, to provide for the issuance of the shares of Preferred Stock in one or more series, and by filing a certificate of designation pursuant to NRS 78.1955, to establish from time to time the number of shares to be included in each such series, and to fix the designation, powers (including voting powers), preferences and rights of each such series and the qualifications, limitations or restrictions thereof, and

WHEREAS, it is the desire of the Board of Directors, pursuant to its authority as aforesaid, to fix the rights, preferences, restrictions and other matters relating to a series of the preferred stock, which shall consist of Fifty Thousand (50,000) shares of the preferred stock which the Corporation has the authority to issue, as follows:

NOW, THEREFORE, BE IT RESOLVED, that the Board of Directors does hereby provide for the issuance of a series of preferred stock as dividends on the outstanding shares of the Corporation’s common stock, par value $0.001 per share (“Common Stock”), at a rate of one one-thousandth (1/1,000th) of a share of such preferred stock per share of Common Stock, and does hereby fix and determine the rights, preferences, restrictions and other matters relating to such series of preferred stock as follows:

TERMS OF SERIES C PREFERRED STOCK

| 1. | Designation, Amount and Par Value. The series of Preferred Stock created hereby shall be designated as the Series C Preferred Stock (the “Series C Preferred Stock”), and the number of shares so designated shall be Fifty Thousand (50,000). Each share of Series C Preferred Stock shall have a par value of $0.001 per share. | |

| 2. | Dividends. The holders of Series C Preferred Stock (the “Holders” and each a “Holder”), as such, shall not be entitled to receive dividends of any kind on shares of Series C Preferred Stock. |

| 3 |

| 3. | Voting Rights. Except as otherwise provided by the Articles of Incorporation or required by law, the Holders of shares of Series C Preferred Stock shall have the following voting rights: | |

| 3.1 | Except as otherwise provided herein, each outstanding share of Series C Preferred Stock shall have 1,000,000 votes per share (and, for the avoidance of doubt, each fraction of a share of Series C Preferred Stock shall have a ratable number of votes). The outstanding shares of Series C Preferred Stock shall vote together with the outstanding shares of Common Stock as a single class exclusively with respect to the Authorized Share Increase and the Adjournment Proposal (all as defined below) and shall not be entitled to vote on any other matter except to the extent required under the NRS. Notwithstanding the foregoing, and for the avoidance of doubt, each share of Series C Preferred Stock (or fraction thereof) redeemed pursuant to the Initial Redemption (as defined below) shall have no voting power with respect to, and the Holder of each share of Series C Preferred Stock (or fraction thereof) redeemed pursuant to the Initial Redemption shall have no voting power with respect to any such share of Series C Preferred Stock (or fraction thereof) on, the Authorized Share Increase, the Adjournment Proposal or any other matter brought before any meeting of stockholders held to vote on the Authorized Share Increase. As used herein, (1) the term “Authorized Share Increase” means any proposal to adopt an amendment to the Articles of Incorporation to increase the number of authorized shares of Common Stock from 40,000,000 shares to 190,000,000 shares and to reflect a corresponding increase in the total number of shares the Corporation is authorized to issue from 50,000,000 shares to 200,000,000 shares, and (2) “Adjournment Proposal” means any proposal to adjourn any meeting of stockholders called for the purpose of voting on the Authorized Share Increase. | |

| 3.2 | Unless otherwise provided on any applicable proxy or ballot with respect to the voting on the Authorized Share Increase or the Adjournment Proposal, the vote of each share of Series C Preferred Stock (or fraction thereof) entitled to vote on the Authorized Share Increase or the Adjournment Proposal shall be cast in the same manner as the vote, if any, of the share of Common Stock (or fraction thereof) in respect of which such share of Series C Preferred Stock (or fraction thereof) was issued as a dividend is cast on the Authorized Share Increase or the Adjournment Proposal, as applicable, and the proxy or ballot with respect to shares of Common Stock held by any Holder on whose behalf such proxy or ballot is submitted will be deemed to include all shares of Series C Preferred Stock (or fraction thereof) held by such Holder. Holders of Series C Preferred Stock will not receive a separate ballot or proxy to cast votes with respect to the Series C Preferred Stock on the Authorized Share Increase, the Adjournment Proposal or any other matter brought before any meeting of stockholders held to vote on the Authorized Share Increase. |

| 4. | Rank; Liquidation. | |

| 4.1 | The Series C Preferred Stock shall rank senior to the Common Stock as to any distribution of assets upon a liquidation, dissolution or winding up of the Corporation, whether voluntarily or involuntarily (a “Dissolution”). For the avoidance of any doubt, but without limiting the foregoing, neither the merger or consolidation of the Corporation with or into any other entity, nor the sale, lease, exchange or other disposition of all or substantially all of the Corporation’s assets shall, in and of itself, be deemed to constitute a Dissolution. | |

| 4.2 | Upon any Dissolution, each Holder of outstanding shares of Series C Preferred Stock shall be entitled to be paid out of the assets of the Corporation available for distribution to stockholders, prior and in preference to any distribution to the holders of Common Stock, an amount in cash equal to $0.001 per outstanding share of Series C Preferred Stock. |

| 4 |

| 5. | Redemption. | |

| 5.1 | All shares of Series C Preferred Stock that are not duly voted by proxy prior to the opening of any meeting of stockholders held to vote on the Authorized Share Increase and the Adjournment Proposal, in the manner as specifically described in the definitive proxy statement (as may be amended and supplemented) filed by the Corporation with the Securities and Exchange Commission (the “SEC”) and made available to the Corporation’s stockholders in connection with such meeting, shall automatically be redeemed by the Corporation as of immediately prior to the opening of such meeting (the “Initial Redemption Time”) without further action on the part of the Corporation or the Holder thereof (the “Initial Redemption”). | |

| 5.2 | Any outstanding shares of Series C Preferred Stock that have not been redeemed pursuant to an Initial Redemption shall be redeemed in whole, but not in part, automatically upon the approval by the Corporation’s stockholders of the Authorized Share Increase at any meeting of stockholders held for the purpose of voting on such proposal (any such redemption pursuant to this Section 5.2, the “Subsequent Redemption”). As used herein, the “Subsequent Redemption Time” shall mean the effective time of the Subsequent Redemption. | |

| 5.3 | Notwithstanding anything to the contrary herein or otherwise, the Board of Directors may, in its sole discretion and at any time, order redemption of all (but not part) of the outstanding shares of Series C Preferred Stock by delivering written notice of redemption to each Holder of record of outstanding shares of Series C Preferred Stock not less than two (2) days prior to the redemption date specified in such notice (the “Discretionary Redemption” and, together with the Initial Redemption and Subsequent Redemption, the “Redemptions”). As used herein, the “Redemption Time” shall mean (i) with respect to the Initial Redemption, the Initial Redemption Time, (ii) with respect to the Subsequent Redemption, the Subsequent Redemption Time, and (iii) with respect to the Discretionary Redemption, such time and date specified by the Board of Directors in its sole discretion for the effectiveness of the Discretionary Redemption. | |

| 5.4 | Each share of Series C Preferred Stock redeemed in any Redemption pursuant to this Section 5 shall be redeemed in consideration for the right to receive an amount equal to $0.01 in cash for each ten whole shares of Series C Preferred Stock that are “beneficially owned” by the “beneficial owner” (as such terms are defined below) thereof as of immediately prior to the applicable Redemption Time and redeemed pursuant to such Redemption, payable upon the applicable Redemption Time; provided, however, that for the avoidance of doubt, the redemption consideration in respect of the shares of Series C Preferred Stock (or fractions thereof) redeemed in any Redemption pursuant to this Section 5: (x) shall entitle the former beneficial owners of less than ten (10) whole shares of Series C Preferred Stock redeemed in any Redemption to no cash payment in respect thereof and (y) shall, in the case of a former beneficial owner of a number of shares of Series C Preferred Stock (or fractions thereof) redeemed pursuant to any Redemption that is not equal to a whole number that is a multiple of ten, entitle such beneficial owner to the same cash payment, if any, in respect of such Redemption as would have been payable in such Redemption to such beneficial owner if the number of shares (or fractions thereof) beneficially owned by such beneficial owner and redeemed pursuant to such Redemption were rounded down to the nearest whole number that is a multiple of ten (such, that for example, the former beneficial owner of 25 shares of Series C Preferred Stock redeemed pursuant to any Redemption shall be entitled to receive the same cash payment in respect of such Redemption as would have been payable to the former beneficial owner of 20 shares of Series C Preferred Stock redeemed pursuant to such Redemption). As used herein, “Person” shall mean any individual, firm, corporation, partnership, limited liability company, trust or other entity, and shall include any successor (by merger or otherwise) to such entity. As used herein, a Person shall be deemed the “beneficial owner” of, and shall be deemed to “beneficially own,” any securities which such Person is deemed to beneficially own, directly or indirectly, within the meaning of Rule 13d-3 of the General Rules and Regulations under the Securities Exchange Act of 1934, as amended. |

| 5 |

| 5.5 | From and after the time at which any shares of Series C Preferred Stock are called for redemption (whether automatically or at the direction of the Board of Directors) in accordance with Sections 5.1, 5.2 or 5.3, such shares of Series C Preferred Stock shall cease to be outstanding, and the only right of the former Holders of such shares of Series C Preferred Stock, as such, will be to receive the applicable redemption price, if any. The shares of Series C Preferred Stock redeemed by the Corporation pursuant to this Certificate of Designation of Series C Preferred Stock of the Corporation (the “Certificate of Designation”) shall, upon such redemption, be automatically retired and restored to the status of authorized but unissued shares of Preferred Stock. Notwithstanding anything to the contrary herein or otherwise, and for the avoidance of doubt, any shares of Series C Preferred Stock (or fraction thereof) that have been redeemed pursuant to an Initial Redemption shall not be deemed to be outstanding for the purpose of voting or determining the number of votes entitled to vote on any matter submitted to stockholders (including the Authorized Share Increase, the Adjournment Proposal or any other matter brought before any meeting of stockholders held to vote on the Authorized Share Increase) from and after the time of the Initial Redemption. Notice of any meeting of stockholders for the submission to stockholders of any proposals to approve the Authorized Share Increase shall constitute notice of a redemption of shares of Series C Preferred Stock pursuant to an Initial Redemption and result in the automatic redemption of the applicable shares of Series C Preferred Stock (and/or fractions thereof) pursuant to the Initial Redemption at the Initial Redemption Time pursuant to Section 5.1 hereof. Notice by the Corporation of the stockholders’ approval of the Authorized Share Increase, whether by press release or by the filing of a Current Report on Form 8-K with the SEC, shall constitute a notice of a redemption of shares of Series C Preferred Stock pursuant to a Subsequent Redemption and result in the automatic redemption of the applicable shares of Series C Preferred Stock (and/or fractions thereof) pursuant to the Subsequent Redemption at the Subsequent Redemption Time pursuant to Section 5.2 hereof. In connection with the filing of this Certificate of Designation, the Corporation has set apart funds for payment for the redemption of all shares of Series C Preferred Stock pursuant to the Redemptions and shall continue to keep such funds apart for such payment through the payment of the purchase price for the redemption of all such shares. | |

| 6. | Transfer. No shares of Series C Preferred Stock may be Transferred (as defined below) by the Holder thereof except in connection with a transfer by such Holder of any shares of Common Stock held thereby, in which case a number of one one-thousandths (1/1,000ths) of a share of Series C Preferred Stock equal to the number of shares of Common Stock to be transferred by such Holder shall be automatically transferred to the transferee of such shares of Common Stock. For the purpose of this Section 6, “Transfer” means, directly or indirectly, whether by merger, consolidation, share exchange, division, or otherwise, the sale, transfer, gift, pledge, encumbrance, assignment or other disposition of the shares of Series C Preferred Stock (or any right, title or interest thereto or therein) or any agreement, arrangement or understanding (whether or not in writing) to take any of the foregoing actions. | |

| 7. | Fractional Shares. The Series C Preferred Stock may be issued in whole shares or in any fraction of a share that is one one-thousandth (1/1,000th) of a share or any integral multiple of such fraction, which fractions shall entitle the Holder, in proportion to such Holder’s fractional shares, to exercise voting rights, participate in distributions upon a Dissolution and have the benefit of any other rights of Holders of Series C Preferred Stock. |

| 8. | Miscellaneous. | |

| 8.1 | Notices. Any and all notices or other communications or deliveries to be provided by the Holders hereunder shall be in writing and delivered personally, or sent by a nationally recognized overnight courier service, addressed to the Corporation, for the attention of the Chief Executive Officer at 190 N. Canon Drive, 4th Floor, Beverly Hills, California 90210, with a copy sent to attention of the Corporation’s Corporate Secretary, facsimile number (310) 273-4202, or such other facsimile number or address as the Corporation may specify for such purposes by notice to the Holders delivered in accordance with this .1. Any and all notices or other communications or deliveries to be provided by the Corporation hereunder shall be in writing and delivered personally, by facsimile, or sent by a nationally recognized overnight courier service addressed to each record Holder at the facsimile number, or address of such Holder appearing on the books of the Corporation. Any notice or other communication or deliveries hereunder shall be deemed given and effective on the earliest of (i) the time of transmission, if such notice or communication is delivered via facsimile at the facsimile number set forth in this Section 8.1 prior to 5:30 p.m. (New York City time) on any Trading Day, (ii) the next Trading Day after the time of transmission, if such notice or communication is delivered via facsimile at the facsimile number set forth in this Section on a day that is not a Trading Day or later than 5:30 p.m. (New York City time) on any Trading Day, (iii) the second Trading Day following the date of mailing, if sent by U.S. nationally recognized overnight courier service, or (iv) upon actual receipt by the party to whom such notice is required to be given. For the purpose of this Section 8.1, (i) “Trading Day” means a day on which the principal Trading Market is open for business, and (ii) “Trading Market” means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date in question: the NYSE American, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market, or the New York Stock Exchange (or any successors to any of the foregoing). | |

| 6 |

| 8.2 | Governing Law. All questions concerning the construction, validity, enforcement and interpretation of this Certificate of Designation shall be governed by and construed and enforced in accordance with the internal laws of the State of Nevada, without regard to the principles of conflict of laws thereof. The rule of construction to the effect that any ambiguities are to be resolved against the drafting party shall not be employed in the interpretation of this Certificate of Designation or any amendments thereto. All legal proceedings concerning the interpretation, enforcement and defense of the transactions contemplated by this Certificate of Designation (whether brought against a party hereto or its respective Affiliates, directors, officers, shareholders, employees or agents) shall be commenced in the federal courts sitting in the State of Nevada (the “Nevada Courts”). | |

| 8.3 | Uncertificated Shares. The shares of Series C Preferred Stock shall be uncertificated and represented in book-entry form. | |

| 8.4 | Waiver. Any waiver by the Corporation or a Holder of a breach of any provision of this Certificate of Designation shall not operate as or be construed to be a waiver of any other breach of such provision or of any breach of any other provision of this Certificate of Designation or a waiver by any other Holders. The failure of the Corporation or a Holder to insist upon strict adherence to any term of this Certificate of Designation on one or more occasions shall not be considered a waiver or deprive that party (or any other Holder) of the right thereafter to insist upon strict adherence to that term or any other term of this Certificate of Designation on any other occasion. Any waiver by the Corporation or a Holder must be in writing. | |

| 8.5 | Severability. If any provision of this Certificate of Designation is invalid, illegal or unenforceable, the balance of this Certificate of Designation shall remain in effect, and if any provision is inapplicable to any Person or circumstance, it shall nevertheless remain applicable to all other Persons and circumstances. If it shall be found that any interest or other amount deemed interest due hereunder violates the applicable law governing usury, the applicable rate of interest due hereunder shall automatically be lowered to equal the maximum rate of interest permitted under applicable law. | |

| 8.6 | Next Business Day. Whenever any payment or other obligation hereunder shall be due on a day other than a Business Day, such payment shall be made or other obligation performed on the next succeeding Business Day. | |

| 8.7 | Headings. The headings contained herein are for convenience only, do not constitute a part of this Certificate of Designation and shall not be deemed to limit or affect any of the provisions hereof. | |

| 8.8 | Amendment. In addition to any other vote or consent required by the Articles of Incorporation (including this Certificate of Designation) or required by law, any of the provisions, terms, rights, powers, preferences and other terms of the Series C Preferred Stock set forth herein may be amended or waived on behalf of all Holders of Series C Preferred Stock by the affirmative written consent or vote of the Holders of at least a majority of the shares of Series C Preferred Stock then outstanding. |

*********************

| 7 |

RESOLVED, FURTHER, that the chief executive officer, the president, the chief financial officer or any vice-president, and the secretary or any assistant secretary, of the Corporation be and they hereby are authorized and directed to prepare and file this Certificate of Designation in accordance with the foregoing resolution and the provisions of Nevada law.

IN WITNESS WHEREOF, the undersigned have executed this Certificate this 25th day of September, 2023.

| /s/ Michael Jaffa | ||

|

Name: Michael Jaffa Title: Chief Operating Officer, General Counsel and Corporate Secretary

|

| 8 |