UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

Kartoon Studios, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee previously paid with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

October 16, 2023

To Our Stockholders:

You are cordially invited to attend a special meeting of stockholders (the “Special Meeting”) of Kartoon Studios, Inc., a Nevada corporation (the “Company”), to be held at 10:00 a.m., Pacific Standard Time, on Wednesday, November 1, 2023. The Special Meeting will be a virtual meeting of stockholders, which will be conducted solely by means of remote communication via a live webcast. For purposes of attendance at the Special Meeting, all references in this proxy statement to “present in person” or “in person” shall mean virtually present at the Special Meeting.

Details regarding the Special Meeting, the business to be conducted at the Special Meeting, and information about the Company that you should consider when you vote your shares are described in this proxy statement.

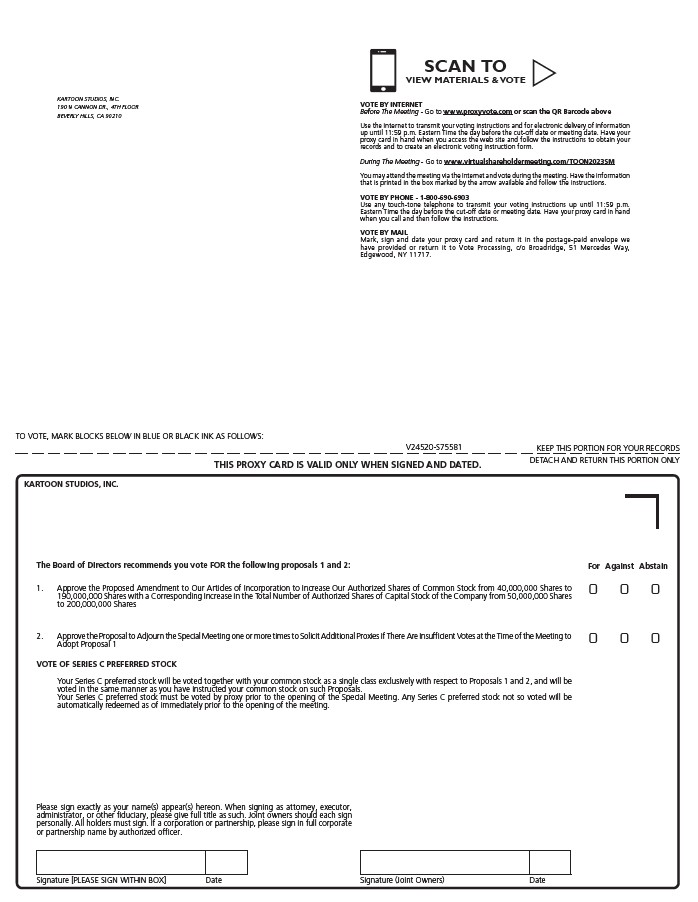

At the Special Meeting, we will ask stockholders to (i) approve a proposed amendment to the Company’s Articles of Incorporation, as amended (the “Articles of Incorporation”), to increase our authorized shares of common stock, par value $0.001 per share (the “Common Stock”), from 40,000,000 shares to 190,000,000 shares with a corresponding increase in the total number of authorized shares of capital stock of the Company from 50,000,000 shares to 200,000,000 shares (Proposal 1), and (ii) approve a proposal to adjourn the Special Meeting one or more times to solicit additional proxies if there are insufficient votes at the time of the meeting to approve Proposal 1 (Proposal 2).

The board of directors recommends the approval of each of the proposals. Such other business will be transacted as may properly come before the Special Meeting.

Under Securities and Exchange Commission rules that allow companies to furnish proxy materials to stockholders over the Internet, we have elected to deliver our proxy materials to the majority of our stockholders over the Internet. This delivery process allows us to provide stockholders with the information they need, while at the same time conserving natural resources and lowering the cost of delivery. On October 16, 2023, we sent to our stockholders either a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement for the Special Meeting via email or a paper copy of the proxy materials by mail. The Notice also provides instructions on how to vote online or by telephone and includes instructions on how to receive a paper copy of the proxy materials by mail.

We hope you will be able to attend the Special Meeting. Whether you plan to attend the Special Meeting or not, it is important that you cast your vote either during the Special Meeting or by proxy before the Special Meeting (provided that shares of Series C Preferred Stock may only be voted by proxy prior to the opening of the Special Meeting, as further described below in the proxy statement). You may vote over the Internet or by mail. When you have finished reading the proxy statement, you are urged to vote in accordance with the instructions set forth in the Notice and this proxy statement. We encourage you to vote by proxy so that your shares will be represented and voted at the meeting, whether or not you can attend.

Thank you for your continued support of the Company. We look forward to seeing you at the Special Meeting.

| Sincerely, | ||

| /s/ Andy Heyward | ||

| Andy Heyward | ||

| Chief Executive Officer and | ||

| Chairman of the Board of Directors | ||

October 16, 2023

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

| TIME: | 10:00 a.m., Pacific Standard Time | |

| DATE: | Wednesday, November 1, 2023 | |

| PLACE: | The Special Meeting will be held by means of remote communication via a live webcast accessible at www.virtualshareholdermeeting.com/TOON2023SM. You can attend the Special Meeting online and vote your shares during the online meeting. To be admitted to the Special Meeting’s live webcast, you must register to attend the virtual meeting by 11:59 p.m., Pacific Standard Time, on Friday, October 27, 2023, by visiting www.proxyvote.com, entering your 16-digit control number as shown in the Notice of Internet Availability of Proxy Materials (“Notice”), your proxy card, or the voting instruction form, and selecting “Attend a Meeting.” You will receive a confirmation email with information on how to attend the Special Meeting. On the day of the meeting, you will be able to participate in the Special Meeting by visiting www.virtualshareholdermeeting.com/TOON2023SM and entering the same 16-digit control number you used to pre-register and as shown in your confirmation email. Participation in the Special Meeting is limited and access to the meeting will be accepted on a first come, first served basis once electronic entry begins. Electronic entry to the Special Meeting will begin at 9:45 a.m., Pacific Standard Time, on the day of the meeting. If you encounter any difficulties accessing the virtual meeting, please call the technical support number that will be posted on the virtual meeting page. | |

| PURPOSES: | ||

| 1. | To approve a proposed amendment to our Articles of Incorporation to increase our authorized shares of Common Stock from 40,000,000 shares to 190,000,000 shares with a corresponding increase in the total number of authorized shares of capital stock of the Company from 50,000,000 shares to 200,000,000 shares (Proposal 1); | |

| 2. | To approve a proposal to adjourn the Special Meeting one or more times to solicit additional proxies if there are insufficient votes at the time of the meeting to adopt Proposal 1 (Proposal 2); and | |

| 3. | To transact such other business that is properly presented at the Special Meeting and any adjournments or postponements thereof. | |

WHO MAY VOTE:

You may vote if you were the record owner of the Company’s Common Stock at 5:00 p.m. Pacific Standard Time on October 4, 2023 (the “Record Date”). A list of stockholders of record will be available during the Special Meeting and the 10 days prior to the Special Meeting at our principal executive offices located at 190 N. Canon Drive, 4th Floor, Beverly Hills, California 90210.

As a result of the dividend of shares of our Series C Preferred Stock, par value $0.001 per share (the “Series C Preferred Stock”), distributed on October 2, 2023, each holder of shares of our Common Stock also holds a number of one one-thousandths of a share of our Series C Preferred Stock equal to the whole number of shares of Common Stock held by such holder. Because any share of Series C Preferred Stock (or fraction thereof) that is not voted by proxy prior to the opening of the Special Meeting will be automatically redeemed as of immediately prior to the opening of this meeting (the “Initial Redemption”), if you fail to submit a proxy to vote your shares of Series C Preferred Stock prior to the opening of the Special Meeting, your shares of Series C Preferred Stock will be redeemed immediately prior to the opening of this meeting and will not be entitled to vote at this meeting.

All stockholders are cordially invited to attend the Special Meeting. Stockholders who plan to attend the Special Meeting must register at www.proxyvote.com by 11:59 p.m., Pacific Standard Time, on Friday, October 27, 2023 (the “Registration Deadline”), as described in your Notice, proxy card, or voting instruction form. As part of the registration process, you must enter the 16-digit control number shown on your Notice, proxy card, or voting instruction form. After completion of your registration by the Registration Deadline, a confirmation email with information on how to attend the Special Meeting will be emailed to you. For purposes of attendance at the Special Meeting, all references in this proxy statement to “present in person” or “in person” shall mean virtually present at the Special Meeting.

Whether you plan to attend the Special Meeting or not, we urge you to vote by following the instructions in the Notice of Internet Availability of Proxy Materials that you previously received and submit your proxy by the Internet or mail in order to ensure the presence of a quorum. You may change or revoke your proxy at any time before it is voted at the Special Meeting (provided that proxy instructions on shares of Series C Preferred Stock may only be changed and/or revoked prior to the opening of the Special Meeting).

| BY ORDER OF THE BOARD OF DIRECTORS | |

| /s/ Michael Jaffa | |

| Michael Jaffa | |

| Corporate Secretary |

TABLE OF CONTENTS

| i |

Kartoon Studios, Inc.

190 N. Canon Drive, 4th Floor

Beverly Hills, CA 90210

PROXY STATEMENT

KARTOON STUDIOS, INC.

SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON WEDNESDAY, NOVEMBER 1, 2023

This proxy statement, along with the accompanying Notice of Special Meeting of Stockholders, contains information about a special meeting of stockholders of Kartoon Studios, Inc. (the “Special Meeting”), including any adjournments or postponements of the Special Meeting. We are holding the Special Meeting at 10:00 a.m. Pacific Standard Time, on Wednesday, November 1, 2023, by means of remote communication via a live webcast accessible at www.virtualshareholdermeeting.com/TOON2023SM.

In this proxy statement, we refer to Kartoon Studios, Inc. as “the Company,” “we” and “us.”

This proxy statement relates to the solicitation of proxies by our board of directors for use at the Special Meeting.

On October 16, 2023, we sent to our stockholders either a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement for the Special Meeting via email or a paper copy of the proxy materials by mail.

| ii |

IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF PROXY MATERIALS FOR THE

A SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON WEDNESDAY, NOVEMBER 1, 2023

This proxy statement, the Notice of Special Meeting of Stockholders and our form of proxy card to stockholders are available for viewing, printing and downloading at www.proxyvote.com. To view these materials please have your 16-digit control number(s) available that appears on your Notice or proxy card. On this website, you can also elect to receive future distributions of our proxy statements to stockholders by electronic delivery.

Exhibits will be provided upon written request and payment of an appropriate processing fee.

| 1 |

IMPORTANT INFORMATION ABOUT THE SPECIAL MEETING AND VOTING

Why is the Company Soliciting My Proxy?

Our board of directors is soliciting your proxy to vote at the special meeting of stockholders to be held by means of remote communication via a live webcast accessible at www.virtualshareholdermeeting.com/TOON2023SM on Wednesday, November 1, 2023, at 10:00 a.m. Pacific Standard Time, and any adjournments or postponements of the meeting, which we refer to hereinafter as the “Special Meeting.” This proxy statement, along with the accompanying Notice of Special Meeting of Stockholders, summarizes the purposes of the meeting and the information you need to know to vote at the Special Meeting.

We have made available to you on the Internet or have sent you this proxy statement, the Notice of Special Meeting of Stockholders and the proxy card because you owned shares of Kartoon Studios, Inc.’s common stock, par value $0.001 per share (the “Common Stock”) on the Record Date (as defined below). On October 16, 2023, we sent to our stockholders either a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement for the Special Meeting via email or a paper copy of the proxy materials by mail.

Why Did I Receive a Notice in the E-Mail Regarding the Internet Availability of Proxy Materials Instead of a Full Set of Proxy Materials?

As permitted by the rules of the U.S. Securities and Exchange Commission (the “SEC”), we may furnish our proxy materials to our stockholders by providing access to such documents on the Internet, rather than mailing printed copies of these materials to each stockholder. Most stockholders will not receive printed copies of the proxy materials unless they request them. We believe that this process should expedite stockholders’ receipt of proxy materials, lower the costs of the Special Meeting and help to conserve natural resources. If you received the Notice electronically, you will not receive a printed or email copy of the proxy materials, unless you request one by following the instructions included in the Notice. Instead, the Notice instructs you as to how you may access and review all of the proxy materials and submit your proxy on the Internet. If you requested a paper copy of the proxy materials, you may authorize the voting of your shares by following the instructions on the proxy card, in addition to the other methods of voting described in this proxy statement.

Why is the Company holding the Special Meeting virtually?

We are holding the Special Meeting online and providing internet voting to facilitate stockholder attendance and participation by enabling all stockholders to participate fully, equally and without cost, using an Internet-connected device from any location around the world, with procedures designed to ensure the authenticity and correctness of your voting instructions. In addition, the virtual-only meeting format increases our ability to engage with all stockholders, regardless of size, resources or physical location. Our stockholders will be afforded the same opportunities to participate at the virtual Special Meeting as they would at an in-person Special Meeting.

Where can I get technical assistance?

If you encounter any difficulties accessing the virtual Special Meeting, please call the technical support number that will be posted at www.virtualshareholdermeeting.com/TOON2023SM.

| 2 |

Who May Vote?

Only stockholders of record who owned our Common Stock at 5:00 p.m., Pacific Standard Time, on October 4, 2023 (the “Record Date”) will be entitled to vote at the Special Meeting.

As a result of the dividend of the shares of our Series C Preferred Stock distributed on October 2, 2023, each holder of shares of our Common Stock also holds a number of one one-thousandths of a share of our Series C Preferred Stock equal to the whole number of shares of Common Stock held by such holder. The shares of Series C Preferred Stock shall be voted together with the shares of Common Stock as a single class with respect to Proposals 1 and 2; provided, however, holders of our outstanding shares of Series C Preferred Stock will only be entitled to vote such shares on Proposals 1 and 2 and only by proxy prior to the opening of the Special Meeting.

On the Record Date, there were 35,068,119 shares of Common Stock and 35,068.119 shares of Series C Preferred Stock outstanding and entitled to vote at the Special Meeting. Our Common Stock and Series C Preferred Stock are our only classes of voting stock. Each share of Common Stock is entitled to one vote, and each outstanding share of Series C Preferred Stock is entitled to 1,000,000 votes (with each fraction of a share of Series C Preferred Stock entitled to a ratable number of votes).

If on the Record Date your shares of Common Stock are registered directly in your name with our transfer agent, VStock Transfer LLC, then you are a stockholder of record.

If on the Record Date your shares are held not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice shall be forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Special Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Special Meeting. However, since you are not the stockholder of record, you may not vote your shares at the Special Meeting unless you request and obtain a legal proxy from your broker or other agent authorizing you to vote your shares when you register for the Special Meeting.

You do not need to attend the Special Meeting to vote your shares. Shares represented by valid proxies, received in time for the Special Meeting and not revoked prior to the Special Meeting will be voted at the Special Meeting. For instructions on how to change or revoke your proxy, see “May I Change or Revoke My Proxy?” below.

How Many Votes Do I Have?

Each share of our Common Stock that you own entitles you to one vote. Each share of our Series C Preferred Stock that you own entitles you to 1,000,000 votes (with each fraction of a share of Series C Preferred Stock entitled to a ratable number of votes).

| 3 |

Whether you plan to attend the Special Meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation and are not revoked will be voted in accordance with your instructions on the proxy card or as instructed via Internet. You may specify whether your shares should be voted for, against or abstain with respect to each of the proposals. If you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the recommendations of our board of directors as noted below. Voting by proxy will not affect your right to attend the Special Meeting. If your shares are registered directly in your name through our stock transfer agent, VStock Transfer LLC, or you have stock certificates registered in your name, you may vote:

| · | By Internet. Follow the instructions included in the Notice or, if you received printed materials, in the proxy card to vote by Internet. | |

| · | By mail. If you received a proxy card by mail, you can vote by mail by completing, signing, dating and returning the proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your shares voted, they will be voted in accordance with the recommendations of our board of directors as noted below. | |

| · | At the Special Meeting. If you attend the Special Meeting virtually, you may vote at the Special Meeting by following the instructions when you log in for the Special Meeting at www.virtualshareholdermeeting.com/TOON2023SM. Have your proxy card or Notice in hand as you will be prompted to enter your 16-digit control number to vote at the Special Meeting. Electronic entry to the Special Meeting will begin 15 minutes before the start of the meeting. |

Notwithstanding of the foregoing, shares of Series C Preferred Stock that are not voted by proxy prior to the opening of the Special Meeting will be automatically redeemed as of immediately prior to the opening of this meeting (the “Initial Redemption”) and, therefore, will not be outstanding or entitled to vote on Proposal 1 or Proposal 2, and will be excluded from the calculation as to whether such proposals pass at the Special Meeting.

Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m., Eastern Daylight Time on Tuesday, October 31, 2023. Telephone and Internet voting facilities for beneficial holders will be available 24 hours a day and will close at 11:59 p.m. Eastern Daylight Time on Tuesday, October 31, 2023.

If your shares are held in “street name” (held in the name of a bank, broker or other holder of record), you will receive instructions from the holder of record. You must follow the instructions of the holder of record in order for your shares to be voted. Telephone and Internet voting also will be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you would like to vote your shares at the Special Meeting, you should contact your broker or agent to obtain a legal proxy authorizing you to vote your shares when you register for the Special Meeting.

How Does Our Board of Directors Recommend that I Vote on the Proposals?

Our board of directors recommends that you vote as follows:

| · | “FOR” the approval of the proposed amendment to our Articles of Incorporation to increase our authorized shares of Common Stock from 40,000,000 shares to 190,000,000 shares with a corresponding increase in the total number of authorized shares of capital stock of the Company from 50,000,000 shares to 200,000,000 shares (Proposal 1); and | |

| · | “FOR” the proposal to adjourn the Special Meeting one or more times to solicit additional proxies if there are insufficient votes at the time of the meeting to adopt Proposal 1 (Proposal 2). |

If any other matter is presented at the Special Meeting, your proxy provides that your shares will be voted by the proxy holder listed in the proxy in accordance with his or her best judgment; provided, however, that holders of our outstanding shares of Series C Preferred Stock will not be entitled to vote such shares on any matters other than Proposals 1 and 2. At the time this proxy statement was first made available, we knew of no matters that needed to be acted on at the Special Meeting, other than those discussed in this proxy statement.

| 4 |

May I Change or Revoke My Proxy?

If you give us your proxy, you may change or revoke it at any time before the Special Meeting. You may change or revoke your proxy in any one of the following ways:

| · | if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above; | |

| · | by re-voting by Internet as instructed above; | |

| · | by notifying Kartoon Studios, Inc.’s Corporate Secretary in writing before the Special Meeting that you have revoked your proxy; or | |

| · | by attending the Special Meeting virtually and voting online. Attending the Special Meeting will not in and of itself revoke a previously submitted proxy. You must specifically vote your shares online at the Special Meeting to revoke your previously submitted proxy. |

Your most current vote, whether by telephone, Internet or proxy card, is the one that will be counted.

Notwithstanding the foregoing, holders of our outstanding shares of Series C Preferred Stock will only be entitled to vote such shares by proxy prior to the opening of the Special Meeting. As such, proxy instructions on shares of Series C Preferred Stock may only be changed and/or revoked prior to the opening of the Special Meeting.

What if I Receive More Than One Notice or Proxy Card?

You may receive more than one Notice or proxy card if you hold shares of our Common Stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described above under “How Do I Vote?” for each account to ensure that all of your shares of Common Stock and shares of Series C Preferred Stock are voted.

Will My Shares be Voted if I Do Not Vote?

If your shares are registered in your name or if you have stock certificates, they will not be counted if you do not vote as described above under “How Do I Vote?” If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above, the bank, broker or other nominee that holds your shares has the authority to vote your unvoted shares only on matters that are deemed “routine,” such as the proposals to approve a proposed amendment to our Articles of Incorporation to increase our authorized shares of Common Stock (Proposal 1) and to adjourn the Special Meeting to solicit additional proxies (Proposal 2). Therefore, we encourage you to provide voting instructions to your bank, broker or other nominee. This ensures your shares will be voted at the Special Meeting in the manner you desire. A “broker non-vote” will occur with respect to Proposal 1 or Proposal 2 if your broker has not received instructions from you and chooses not to vote on such Proposal.

| 5 |

What Vote is Required to Approve Each Proposal and How are Votes Counted?

|

Proposal 1: Approve the Proposed Amendment to Our Articles of Incorporation to Increase Our Authorized Shares of Common Stock from 40,000,000 Shares to 190,000,000 Shares with a Corresponding Increase in the Total Number of Authorized Shares of Capital Stock of the Company from 50,000,000 Shares to 200,000,000 Shares

|

The affirmative vote of a majority of the voting power of the outstanding shares of Common Stock (either present in person or represented by proxy at the Special Meeting) and Series C Preferred Stock (by proxy only prior to the opening of the Special Meeting), voting together as a single class, is required to approve the amendment to our Articles of Incorporation to increase our authorized shares of Common Stock from 40,000,000 to 190,000,000 with a corresponding increase in the total number of authorized shares of capital stock of the Company from 50,000,000 shares to 200,000,000 shares. Abstentions will be treated as votes against this proposal. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have the same effect as a vote against this proposal. | |

| Proposal 2: Approve the Proposal to Adjourn the Special Meeting to Solicit Additional Proxies if There Are Insufficient Votes at the Time of the Meeting to Adopt Proposal 1 | The affirmative vote of a majority of the shares of Common Stock (either present in person or represented by proxy at the Special Meeting) and Series C Preferred Stock (by proxy only prior to the opening of the Special Meeting), voting together as a single class, cast affirmatively or negatively at the Special Meeting, is required to approve the proposal to adjourn the Special Meeting one or more times to solicit additional proxies if there are insufficient votes at the time of the meeting to adopt Proposal 1. Abstentions will have no effect on the results of this vote. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. | |

Is Voting Confidential?

We will keep all the proxies, ballots and voting tabulations private. We only let our inspector of election, CT Hagberg LLC, examine these documents. Management will not know how you voted on a specific proposal unless it is necessary to meet legal requirements. We will, however, forward to management any written comments you make on the proxy card or otherwise provide.

Where Can I Find the Voting Results of the Special Meeting?

The preliminary voting results will be announced at the Special Meeting, and we will publish preliminary, or final results if available, in a Current Report on Form 8-K within four business days of the Special Meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended Current Report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

| 6 |

What Are the Costs of Soliciting these Proxies?

We will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone, fax or email. We will not pay these directors and employees any additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses.

We have engaged Morrow Sodali LLC (“Morrow”) to act as our proxy solicitor in connection with the proposals to be acted upon at the Special Meeting. For such services, we will pay Morrow an estimated fee of $10,000 plus reasonable expenses.

What Constitutes a Quorum for the Special Meeting?

The presence, in person or by proxy, of stockholders entitled to cast at least 33.34% of all the votes entitled to be cast at the Special Meeting is necessary to constitute a quorum for the Special Meeting. The shares may be present in person or represented by proxy at the Special Meeting. However, shares that are automatically redeemed in the Initial Redemption will not be counted towards the presence of a quorum or as part of the issued and outstanding shares of capital stock of the Company entitled to vote at the Special Meeting for purposes of determining the presence of a quorum. Abstentions and “broker non-votes” will be counted as present and entitled to vote for purposes of determining a quorum at the Special Meeting.

Attending the Special Meeting

The Special Meeting will be held at 10:00 a.m., Pacific Standard Time, on Wednesday, November 1, 2023, solely by means of remote communication via a live webcast accessible at www.virtualshareholdermeeting.com/TOON2023SM.

All stockholders may attend the Special Meeting. For stockholders who plan to attend the Special Meeting, you must register at www.proxyvote.com by 11:59 p.m., Pacific Standard Time, on Friday, October 27, 2023 (the “Registration Deadline”), as described in your Notice, proxy card, or voting instruction form. As part of the registration process, you must enter the 16-digit control number shown on your Notice, proxy card, or voting instruction form. After completion of your registration by the Registration Deadline, a confirmation email with information on how to attend the Special Meeting will be emailed to you.

You need not attend the Special Meeting in order to vote.

Householding of Special Disclosure Documents

SEC rules concerning the delivery of annual disclosure documents allow us or your broker to send a single Notice or, if applicable, a single set of our proxy materials to any household at which two or more of our stockholders reside, if we or your broker believe that the stockholders are members of the same family. This practice, referred to as “householding,” benefits both you and us. It reduces the volume of duplicate information received at your household and helps to reduce our expenses. The rule applies to our Notices, annual reports, proxy statements and information statements. Once you receive notice from your broker or from us that communications to your address will be “householded,” the practice will continue until you are otherwise notified or until you revoke your consent to the practice. Stockholders who participate in householding will continue to have access to and utilize separate proxy voting instructions.

If your household received a single Notice or, if applicable, a single set of proxy materials this year, but you would prefer to receive your own copy, please contact our proxy service agent, Broadridge Financial Solutions, Inc., by calling their toll-free number, 1-866-540-7095.

| 7 |

If you do not wish to participate in “householding” and would like to receive your own Notice or, if applicable, set of the Company’s proxy materials in future years, follow the instructions described below. Conversely, if you share an address with another Company stockholder and together both of you would like to receive only a single Notice or, if applicable, set of proxy materials, follow these instructions:

If your Company shares are registered in your own name, please contact our proxy service agent, Broadridge Financial Solutions, Inc., and inform them of your request by calling them at 1-866-540-7095 or writing them at Broadridge Financial Solutions, Inc., 51 Mercedes Way, Edgewood, NY 11717, Attn: Broadridge Householding Department. If a broker or other nominee holds your Company shares, please contact the broker or other nominee directly and inform them of your request.

Electronic Delivery of Company Stockholder Communications

Most stockholders can elect to view or receive copies of future proxy materials over the Internet instead of receiving paper copies in the mail.

You can choose this option and save the Company the cost of producing and mailing these documents by:

| · | following the instructions provided on your Notice or proxy card; or | |

| · | following the instructions provided when you vote over the Internet at www.proxyvote.com. |

| 8 |

PROPOSAL 1 – INCREASE OF THE AUTHORIZED SHARES OF COMMON STOCK

The board of directors has determined that it is advisable, in order to provide the Company with the flexibility to take advantage of opportunities which may arise in its industry, especially value-accretive partnerships and acquisitions, to increase our authorized shares of Common Stock from 40,000,000 shares to 190,000,000 shares with a corresponding increase in the total number of authorized shares of capital stock of the Company from 50,000,000 shares to 200,000,000 shares, and has voted to recommend that the stockholders adopt an amendment to our Articles of Incorporation effecting the proposed increase (the “Share Increase Amendment”). As a leader in the business of developing, producing, marketing and licensing branded entertainment properties and consumer products, the Company must, in the view of the board of directors, position itself to nimbly enter into strategic partnerships and value-accretive transactions in order to grow its brand portfolio ahead of the industry as a whole. The lack of authorized shares of Common Stock available for issuance could undermine the Company’s ability to so position itself. Further description of the background and reasons for the amendment is provided below under “Background and Purpose of the Share Increase Amendment,” and the full text of the proposed amendment to the Articles of Incorporation is attached to this proxy statement as Appendix A.

Overview

The Articles of Incorporation currently authorize the issuance of 40,000,000 shares of Common Stock, and 10,000,000 shares of preferred stock, par value $0.001 per share (the “Preferred Stock”). The board of directors approved the Share Increase Amendment, which amends Article IV of the Articles of Incorporation to increase the number of authorized shares of Common Stock from 40,000,000 shares to 190,000,000 shares and, correspondingly, to increase the total number of shares of all classes of capital stock that the Company has authority to issue from 50,000,000 to 200,000,000 shares.

The proposed Share Increase Amendment would amend Sections 4.01 and 4.02 of Article IV of the Articles of Incorporation, respectively, to read in their entirety as follows:

“4.01 Authorized Capital Stock. The total number of shares of stock this Corporation is authorized to issue shall be two hundred million (200,000,000) shares. This stock shall be divided into two classes to be designated as “Common Stock” and “Preferred Stock.”

“4.02 Common Stock. The total number of authorized shares of Common Stock shall be one hundred ninety million (190,000,000) shares with par value of $0.001 per share. Each share of Common Stock, when issued, shall have one (1) vote on all matters presented to the stockholders.”

As of October 4, 2023, there were:

| · | 35,068,119 shares of Common Stock issued and outstanding (excluding treasury shares); | |

| · | 6,852,952 shares of Common Stock underlying outstanding warrants; | |

| · | 1,172,810 shares of Common Stock underlying outstanding stock options; | |

| · | 1,009,899 shares of Common Stock underlying outstanding restricted stock units (“RSUs”); | |

| · | 0 shares reserved for issuance under our Kartoon Studios, Inc. 2015 Incentive Plan, as amended (the “2015 Plan”); and | |

| · | 208,469 shares reserved for issuance under our Kartoon Studios, Inc. 2020 Incentive Plan, as amended (the “2020 Plan”). |

As a result, we may not have enough shares of Common Stock available for future issuance. An aggregate of 9,244,130 shares of Common Stock are either issuable upon the exercise of existing warrants, options and RSUs to purchase Common Stock or reserved under the 2020 Plan, and such amount could be higher to the extent there are future dilutive issuances at lower prices. As noted above, the lack of authorized shares of Common Stock available for issuance could unnecessarily limit or delay our ability to pursue future equity financings, acquisitions and other strategic transactions. We could also be limited in our ability to effectuate future stock dividends.

Included in the convertible securities described above are the common stock purchase warrants that the Company issued to certain investors on June 26, 2023 to purchase up to an aggregate of 4,623,100 shares of Common Stock (the “Exchange Warrants”), the exercisability of which is pending the approval of this Proposal 1, pursuant to that certain warrant inducement offer letter (the “Inducement Letter”). Descriptions of the Exchange Warrants and Inducement Letter were included in our Current Reports on Form 8-K filed with the SEC on June 27, 2023 and July 3, 2023. Stockholder approval of this Proposal 1 is necessary to provide the Company with a sufficient amount of authorized shares of Common Stock available for issuance upon exercise of the warrants (including the Exchange Warrants), options and incentive awards currently outstanding described above, or otherwise reserved for issuance under our existing incentive plans, as well as for future issuances for equity financings, acquisitions and other strategic transactions (although the Company currently does not have any plans for any such future issuances for equity financings, acquisitions or other transactions).

| 9 |

It is important that the Company have a sufficient number of authorized but unissued shares of Common Stock available following the exercise of the Exchange Warrants, to provide the Company with sufficient flexibility to, among other things, undertake important strategic initiatives the board of directors may approve from time to time, including those described above.

Background and Purpose of the Share Increase Amendment

The board of directors believes it is in the Company’s and the Company’s stockholders’ best interest to increase the number of authorized shares of Common Stock to 190,000,000. This amendment is, in the judgment of the board of directors, necessary to provide adequate authorized share capital to provide flexibility for future issuances of Common Stock if determined by the board of directors to be in the best interests of the Company without incurring the risk, delay and potential expense incident to obtaining stockholder approval for a particular issuance. The board of directors believes such flexibility will be instrumental to enable the Company to efficiently take advantage of accretive opportunities, largely targeting acquisitions, which may arise and provide enriched stockholder value as the media industry undergoes a period of consolidation. Future activities may include, but are not limited to:

| · | establishing strategic relationships with other companies; | |

| · | acquiring other businesses or assets; | |

| · | raising capital through sales of equity securities (issuances of shares of common stock or debt or equity securities that are convertible into common stock); | |

| · | providing equity incentives to employees, officers or directors; | |

| · | declaring stock dividends; and | |

| · | achieving other corporate purposes. |

Furthermore, as a material condition to the Inducement Letter, the Company agreed to submit and recommend this proposal to its stockholders in order to be able to issue the shares of Common Stock issuable upon exercise of the Exchange Warrants. Pursuant to the terms of the Inducement Letter, if we do not obtain stockholder approval for this Proposal 1, we have agreed to call a meeting of stockholders every 90 days thereafter to seek stockholder approval until the necessary stockholder approval is obtained, which will result in additional management resources and expenses to the Company.

Other than as described in the preceding paragraph, we currently do not have any plan to issue shares of Common Stock. The board of directors believes the additional authorized shares of Common Stock should be available for financing and other corporate purposes, in order to enable the Company to efficiently take advantage of accretive opportunities which may arise in the Company’s industry without the potential expense and delay incident to obtaining stockholder approval for a particular financing or other issuance.

Effects of the Proposed Share Increase Amendment

If the Share Increase Amendment is approved by our stockholders, it will become effective immediately upon the filing of a Certificate of Change to the Articles of Incorporation with the Secretary of State of the State of Nevada, which we expect to file promptly after the Special Meeting. No further action on the part of stockholders will be required to implement the Share Increase Amendment. If the proposed amendment is not approved by our stockholders, the authorized shares of our Common Stock will remain unchanged and we may not be able to comply with all of our obligations relating to the exercise of outstanding warrants, options and other contractual rights to Common Stock or to issue additional securities in the future because we would not have a sufficient number of shares of Common Stock authorized and available for issuance upon the exercise of all such securities, as the case may be.

| 10 |

The additional shares of authorized Common Stock would be identical to the shares of Common Stock now authorized and outstanding, and the Share Increase Amendment would not affect the rights of current holders of Common Stock. Any issuances of additional shares of Common Stock, however, could adversely affect the existing holders of shares of Common Stock by diluting their ownership, voting power and earnings per share and book value per share with respect to such shares.

The current holders of Common Stock do not have preemptive rights to purchase any shares of Common Stock that may be issued and the board of directors has no plans to grant such rights with respect to any such shares. The Company is currently authorized to issue up to 10,000,000 shares of Preferred Stock, of which (i) 6,000 shares have been designated as 0% Series A Convertible Preferred Stock (the “Series A Preferred Stock”), and zero shares of Series A Convertible Preferred Stock were outstanding as of October 2, 2023, (ii) one share has been designated as Series B Preferred Stock (the “Series B Preferred Stock”), and one share of Series B Preferred Stock was outstanding as of October 2, 2023, and (iii) 50,000 shares have been designated as Series C Preferred Stock (the “Series C Preferred Stock”), and 35,068.119 shares of Series C Preferred Stock were outstanding as of October 2, 2023. The board of directors has the authority to determine the price, rights, preferences, privileges and restrictions, including voting rights and the right to convert any preferred stock into shares of Common Stock, of the unissued shares of preferred stock without any further vote or action by the stockholders. The proposed Share Increase Amendment will not affect this authorization.

As a general matter, the board of directors would be able to issue or reserve for issuance the additional shares of Common Stock in its discretion from time to time, without further action or approval of the Company’s stockholders, subject to and as limited by applicable law, regulation and the rules or listing requirements of any then applicable securities exchange.

Possible Anti-Takeover Effects of the Share Increase Amendment

The board of directors is unaware of any specific effort to obtain control of the Company and therefore has no present intention of using the proposed increase in the number of authorized shares of Common Stock as an anti-takeover device. However, the Company’s authorized but unissued Common Stock could (within the limits imposed by applicable law, regulation and the rules or listing requirements of any then applicable securities exchange) be issued in one or more transactions that could make a change of control much more difficult and therefore more unlikely.

If this proposal is approved, we will not solicit further authorization by vote of the stockholders for the issuance of the additional shares of Common Stock proposed to be authorized, except as required by law, regulatory authorities or rules of NYSE American LLC or any other stock exchange on which our shares may then be listed. The issuance of additional shares of Common Stock could have the effect of diluting existing stockholder earnings per share, book value per share and voting power.

Required Vote

The affirmative vote of a majority of the voting power of the outstanding shares of Common Stock (either present in person or represented by proxy at the Special Meeting) and Series C Preferred Stock (by proxy only prior to the opening of the Special Meeting), voting together as a single class, is required to approve the amendment to our Articles of Incorporation to effect the proposed increase in our authorized shares of Common Stock from 40,000,000 shares to 190,000,000 shares and a corresponding increase in the total number of authorized shares of capital stock of the Company from 50,000,000 shares to 200,000,000 shares.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE TO APPROVE THE AMENDMENT TO OUR ARTICLES OF INCORPORATION. PROXIES SOLICITED BY THE BOARD WILL BE VOTED “FOR” the SHARE INCREASE AMENDMENT UNLESS A STOCKHOLDER INDICATES OTHERWISE ON THEIR PROXY.

| 11 |

PROPOSAL 2 — ADJOURNMENTS TO SOLICIT ADDITIONAL PROXIES

Stockholders are being asked to grant authority to the proxy holders to vote in favor of one or more adjournments of the Special Meeting, if necessary, to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to approve Proposal 1. If this proposal is approved, the Special Meeting could be adjourned one or more times to a future date. We do not intend to call a vote on adjournments of the meeting to solicit additional proxies if the adoption of Proposal 1 is approved at the meeting. Among other things, approval of the adjournment, postponement or continuation proposal could mean that, even if proxies representing a sufficient number of votes against Proposal 1 have been received, we could adjourn, postpone or continue the Special Meeting without a vote on Proposal 1 and seek to convince the holders of those shares to change their votes to votes in favor of the approval of Proposal 1. If the meeting is adjourned to solicit additional proxies, stockholders who have already submitted their proxies will be able to revoke them at any time prior to their use.

Required Vote

The affirmative vote of a majority of the shares of Common Stock (either present in person or represented by proxy at the Special Meeting) and Series C Preferred Stock (by proxy only prior to the opening of the Special Meeting), voting together as a single class, cast affirmatively or negatively at the Special Meeting is required to approve the proposal to adjourn the Special Meeting, if necessary, to solicit additional proxies.

Recommendation of the Board of Directors

THE BOARD RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” ADJOURNMENTS OF THE SPECIAL MEETING, IF NECESSARY, TO SOLICIT ADDITIONAL PROXIES IF THERE ARE INSUFFICIENT VOTES AT THE TIME OF THE MEETING TO ADOPT PROPOSAL 1. PROXIES SOLICITED BY THE BOARD WILL BE VOTED “FOR” SUCH ADJOURNMENTS UNLESS A STOCKHOLDER INDICATES OTHERWISE ON THEIR PROXY.

| 12 |

Our board of directors knows of no other business which will be presented to the Special Meeting. If any other business is properly brought before the Special Meeting, proxies will be voted in accordance with the judgment of the persons named therein.

STOCKHOLDER PROPOSALS AND NOMINATIONS FOR DIRECTOR

To be considered for inclusion in the proxy statement relating to our 2024 annual meeting of stockholders, we must receive stockholder proposals (other than for director nominations) no later than March 16, 2024; provided, however, that if the date of this year’s annual meeting has been changed by more than 30 days from the date of the previous year’s meeting, then the deadline is a reasonable time before the Company begins to print and send its proxy materials. To be considered for presentation at the 2024 annual meeting, although not included in the proxy statement, proposals (including director nominations that are not requested to be included in our proxy statement) must be received no earlier than April 27, 2024 and no later than May 27, 2024; provided, however, that if the date of the annual meeting is more than 30 days before or more than 60 days after such anniversary date, notice by the stockholder to be timely must be so delivered, or mailed and received, not later than the 90th day prior to such annual meeting or, if such annual meeting is announced later than the 90th day prior to the date of such annual meeting, the 10th day following the day on which public disclosure of the date of such annual meeting was first made. In no event shall any adjournment of an annual meeting or the announcement thereof commence a new time period for the giving of timely notice as described above. Proposals must comply with the requirements as to form and substance established by the SEC for such proposals in order to be included in the proxy statement. Proposals that are not received in a timely manner will not be voted on at the 2024 annual meeting. If a proposal is received on time, the proxies that management solicits for the meeting may still exercise discretionary voting authority on the proposal under circumstances consistent with the proxy rules of the SEC. All stockholder proposals should be marked for the attention of the Corporate Secretary at 190 N. Canon Drive, 4th Floor, Beverly Hills, California 90210.

In order for stockholders to give timely notice of nominations for directors, other than those nominated by the Company, for inclusion on a universal proxy card in connection with the 2024 annual meeting, notice must be submitted no later than June 26, 2024 and include all of the information required by Rule 14a-19 under the Exchange Act. However, if the date of the 2024 annual meeting changes by more than 30 days from the 2023 annual meeting, Rule 14a-19 requires the notice be provided by the later of 60 calendar days prior to the date of the 2024 annual meeting or the tenth (10th) calendar day following the day on which we first publicly announce the date of the 2024 annual meeting.

Beverly Hills, California

October 16, 2023

| 13 |

FORM OF

CERTIFICATE OF CHANGE

OF

KARTOON STUDIOS, INC.

INSTRUCTIONS: 1. Enter the current name as on file with the Nevada Secretary of State and enter the Entity or Nevada Business Identification Number (NVID). 2. Indicate the current number of authorized shares and par value, if any, and each class or series before the change. 3. Indicate the number of authorized shares and par value, if any of each class or series after the change. 4. Indicate the change of the affected class or series of issued, if any, shares after the change in exchange for each issued share of the same class or series. 5. Indicate provisions, if any, regarding fractional shares that are affected by the change. 6. NRS required statement. 7. This section is optional. If an effective date and time is indicated the date must not be more than 90 days after the date on which the certificate is filed. 8. Must be signed by an Officer. Form will be returned if unsigned. Name of entity as on file with the Nevada Secretary of State: KARTOON STUDIOS, INC. Entity or Nevada Business Identification Number (NVID): E0515682011 - 9 1. Entity Information: The current number of authorized shares and the par value, if any, of each class or series, if any, of shares before the change: 40,000,000 shares of Common Stock par value $0.001 per share 10,000,000 shares of Preferred stock, par value $0.001 per share 2. Current Authorized Shares: The number of authorized shares and the par value, if any, of each class or series, if any, of shares after the change: 190,000,000 shares of Common Stock par value $0.001 per share 10,000,000 shares of Preferred stock, par value $0.001 per share 3. Authorized Shares After Change: The number of shares of each affected class or series, if any, to be issued after the change in exchange for each issued share of the same class or series: 4. Issuance: The provisions, if any, for the issuance of fractional shares, or for the payment of money or the issuance of scrip to stockholders otherwise entitled to a fraction of a share and the percentage of outstanding shares affected thereby : No fractional shares will be issued 5. Provisions: The required approval of the stockholders has been obtained. 6. Provisions: Date: 11/01/2023 Time: 12:00 p.m. PST (must not be later than 90 days after the certificate is filed) 7. Effective date and time: (Optional) X Signature of Officer Title Date 8. Signature: (Required) FRANCISCO V. AGUILAR Secretary of State 401 North Carson Street Carson City, Nevada 89701 - 4201 (775) 684 - 5708 Website: www.nvsos.gov Certificate of Change Pursuant to NRS 78.209 TYPE OR PRINT - USE DARK INK ONLY - DO NOT HIGHLIGHT This form must be accompanied by appropriate fees. If necessary, additional pages may be attached to this form. Page 1 of 1 Revised: 8/1/2023

| A-1 |